Acquisition Insights

Get access to our comprehensive catalogue of insights on every aspect of the industry.

Categories

Latest Insight Article

Hotel insolvencies up, but business travel could provide a boost

- April 2024

A new report has revealed a significant increase in UK hotel insolvencies over the past year, as operators continue to struggle with a slew of adverse conditions. However, a potential recovery in business travel during 2024 suggests there could be light at the end of the tunnel for an industry that ...

-

INDUSTRY INSIGHTS SME business activity expanding at 'solid rate' in 2024

INDUSTRY INSIGHTS SME business activity expanding at 'solid rate' in 2024Business activity among UK SMEs has expanded at a solid rate throughout the first quarter of the yea...

-

SECTOR GUIDES Administrations and tentative confidence hint at retail M&A opportunities

SECTOR GUIDES Administrations and tentative confidence hint at retail M&A opportunitiesConfidence is reported to be growing in the UK’s retail sector, despite insolvencies in the indust...

-

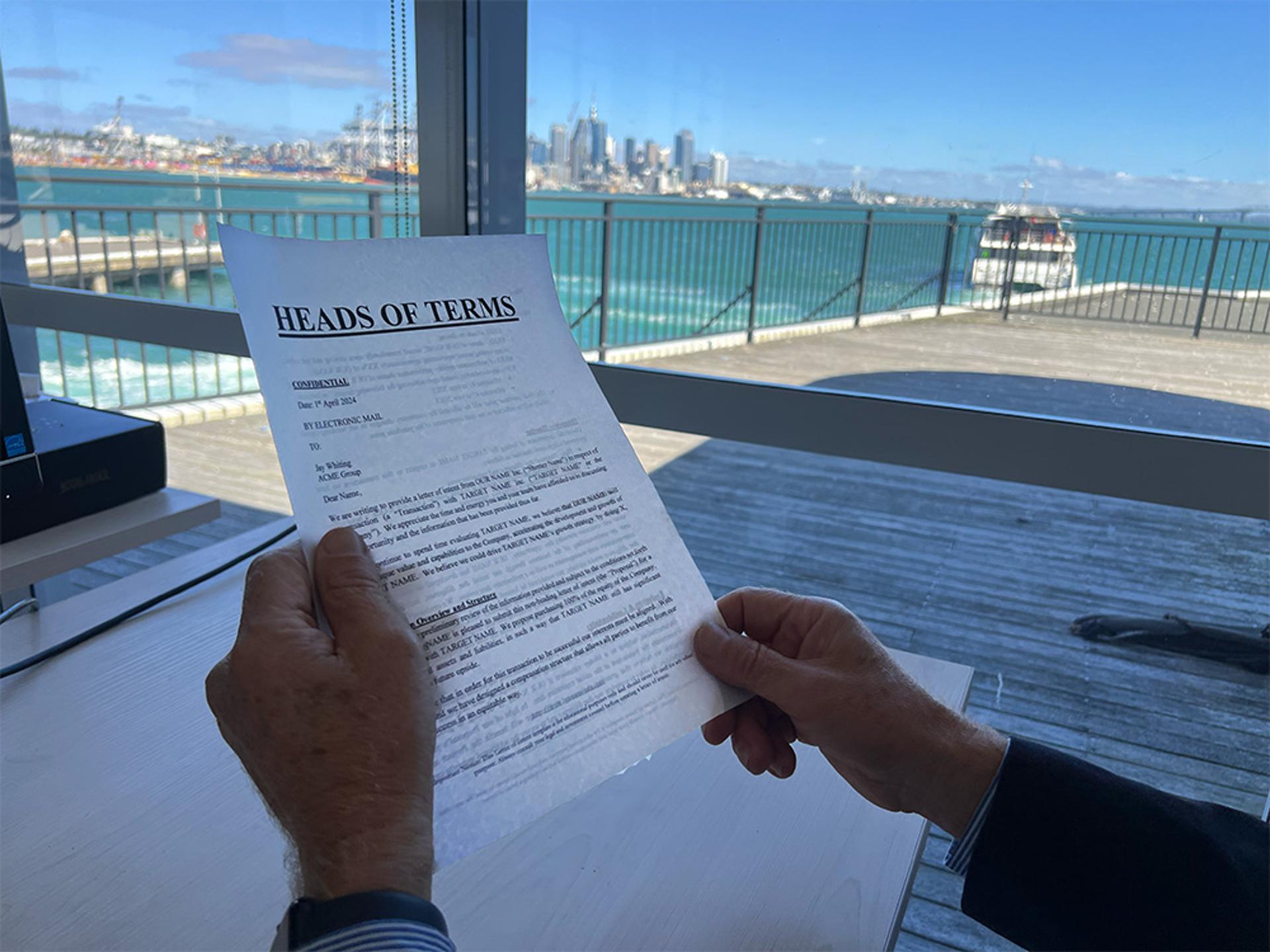

FOR BUYERS Heads of Terms: An invaluable tool in M&A

FOR BUYERS Heads of Terms: An invaluable tool in M&AHeads of Terms (HoT), also known as heads of agreement, memorandum of understanding or letter of int...

-

DEAL INSIGHT Startup vs long-established company

DEAL INSIGHT Startup vs long-established companyLearn about the difference between acquiring a startup and a long-established business....

-

FOR BUYERS AI in M&A: How can buyers and sellers harness the technology?

FOR BUYERS AI in M&A: How can buyers and sellers harness the technology?Before too long, artificial intelligence (AI) will come to play a central role in M&A on both the bu...

-

INDUSTRY INSIGHTS Brewing insolvencies up 82 per cent in 2023 amid hospitality woes

INDUSTRY INSIGHTS Brewing insolvencies up 82 per cent in 2023 amid hospitality woesResearch has revealed that the UK brewing sector saw a more than 80 per cent increase in insolvencie...

-

FOR SELLERS Third of UK SME owners don't know company’s value

FOR SELLERS Third of UK SME owners don't know company’s valueNew research has found that one-third of UK SME business owners (33 per cent) do not know the value ...

-

-

SECTOR GUIDES UK insurance M&A defies EMEA slowdown

SECTOR GUIDES UK insurance M&A defies EMEA slowdownA new report has revealed that M&A activity in the UK’s insurance sector increased last year, desp...

-

INDUSTRY INSIGHTS Dealmakers expect M&A disputes to increase in 2024

INDUSTRY INSIGHTS Dealmakers expect M&A disputes to increase in 2024A new poll has found that global dealmakers expect M&A disputes to increase during 2024 as a result ...

-

FOR BUYERS Intellectual Property in M&A – The key due diligence considerations

FOR BUYERS Intellectual Property in M&A – The key due diligence considerationsIntellectual property (IP) is playing an ever more important role in M&A transactions, as companies ...

-

INDUSTRY INSIGHTS UK deal value rises despite tough conditions

INDUSTRY INSIGHTS UK deal value rises despite tough conditionsNew data from the Office for National Statistics has revealed that UK M&A deal value increased durin...

-

FOR SELLERS Selling a consultancy business

FOR SELLERS Selling a consultancy businessAs we’ve covered in recent insights on professional services and the environmental and sustainabil...

-

SECTOR GUIDES Digital, automation and green transition set to revive manufacturing M&A

SECTOR GUIDES Digital, automation and green transition set to revive manufacturing M&AA new report has forecast that digital transformation, automation and the green transition will be t...

-

SECTOR GUIDES Quarter of UK hospitality firms have exhausted cash reserves

SECTOR GUIDES Quarter of UK hospitality firms have exhausted cash reservesAccording to a new survey, a quarter of UK hospitality companies say they have exhausted their cash ...

-

INDUSTRY INSIGHTS Alternative lenders claim significant M&A market share in 2023

INDUSTRY INSIGHTS Alternative lenders claim significant M&A market share in 2023New data has revealed that alternative lenders claimed a significant share of the UK M&A market in 2...