Buy a business in the UK

The first step along the road to buying a business is to decide what kind of business you want and then create a shortlist. Try a free-text search here or click on a business category or region below.

Latest businesses for sale

Why buy a business?

So you want to buy a UK business?

You've come to the right place. We specialise in providing a comprehensive overview of profitable UK businesses for sale alongside distressed business listings, including administrations and liquidations, all in one place.

Businesses for sale are submitted directly by business owners, brokers and accountants throughout the UK. All businesses listed for sale are reviewed before appearing on our website and printed publication, available only to our members. For over 25 years we have helped buyers find their perfect acquisitions.

Get your business for sale featured on this page and be seen by thousands of buyers daily

List a business with Business Sale Report and get extra exposure by promoting it here. Appear here and at the top of the page for all business searches for just £30.

Browse businesses for sale by sector

-

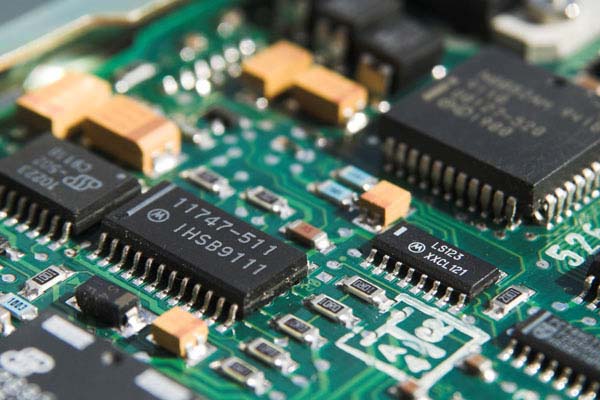

Technology

TechnologyIncludes: software development & solutions, cloud computing, SAAS, hardware, website development, CRM, IT maintenance, IT solutions, hosting, IT support, cyber security, apps, telecoms & VoIP.

-

Medical

MedicalIncludes: nursing & care homes, medical supplies, healthcare practices, pharmaceuticals, dentists, opticians, specialist training providers, medical technology & specialist medical companies

-

Engineering

EngineeringIncludes: precision engineering, bespoke fabrication solutions, metal fabrication, energy & gas services, laser cutting, civil & structural engineering, injection moulding & tooling.

-

Manufacturing

ManufacturingIncludes: bespoke design & manufacture, windows & doors, tools, steel, plastic components, foundries, fasteners, frames, electrical equipment, packaging, furniture, joinery & cabinets.

-

Services

ServicesIncludes: security & alarms, contract cleaning, gardening & landscaping, printers, waste recycling, hospitality, mailing houses, kitchen & bathrooms, garages, MOT & motor repairs.

-

Food & Restaurants

Food & RestaurantsIncludes: food importers, bakeries, food manufacturers, butchers, shellfish & seafood farmers, food processors, breweries, groceries, restaurants & delicatessens.

-

Professional & Financial

Professional & FinancialIncludes: accountancy firms, recruitment agencies, estate agents, property management, consultancies, architectural practices, solicitor firms, surveying, insurance & mortgage brokers.

-

Wholesale & Distribution

Wholesale & DistributionIncludes: transport & logistics, wholesalers, suppliers, importers, haulage, distribution, couriers, mail order, online wholesalers & distributors.

-

Building & Construction

Building & ConstructionIncludes: shop-fitting, trade services, demolition, maintenance, fencing, building restoration, building suppliers, contractors, refurbishment & decorating.

-

Retail

RetailIncludes: DIY & hardware retailers, beauty, jewellery, clothing, furniture, kitchens & bathrooms showrooms, electrical goods, pet supplies, car & motorbike dealerships, larger stores & chains.

-

Advertising & Media

Advertising & MediaIncludes: publishers, PR agencies, media companies, TV production, print services, digital marketing agencies, market research & exhibition events.

-

Leisure & Lifestyle

Leisure & LifestyleIncludes: pubs, vineyards, golf courses, health & leisure clubs, gyms, activity businesses, Travel agents, lifestyle businesses, clubs & bars, private venues, coffee shops & cafes.

-

Hotels & Property

Hotels & PropertyIncludes: hotels, commercial property, property portfolios, property developers, property services, holiday parks & cottages, guest houses, inns, caravan & touring parks.

-

Education

EducationIncludes: language schools, child care, day nurseries and preschools, training, online learning, children's activity centres & pre-schools.

-

Asset sale & Fast sales

Asset sale & Fast salesIncludes: company assets for sale, online asset sales, businesses looking to sell quickly, businesses with offer deadlines, pre-administration businesses for sale.

Looking to buy a small business for sale?

Buying a Micro Business? If you are looking to buy a business smaller than those listed on this site i.e. with annual sales turnover of less than £300,000, then visit our sister site BizSale.co.uk