Find the right buyer for your business today

Create a free listingThe manufacturing industry in the UK accounts for £6.7 trillion of the total British economy, and has proven itself to be a growing and thriving industry. Responsible for employing up to 2.6 million individuals across the nation, manufacturing also makes up 44 per cent of all UK exports, and is 11 per cent of GVA. No doubt, this industry is a lucrative one for all those looking to make it big in the British world of business.

It is, therefore, no surprise that selling your manufacturing company to potential buyers in this space is a challenging task, given the complexities intrinsic to the industry itself. However, with the right support backing you from a tax, financial and legal standpoint, the chances of you running into severe issues that may impact your ability to seal the deal are reduced.

And thus, the main question is: what kinds of problems will you encounter during the sales process, and how might you get around them to lessen the doubt in the minds of potential buyers?

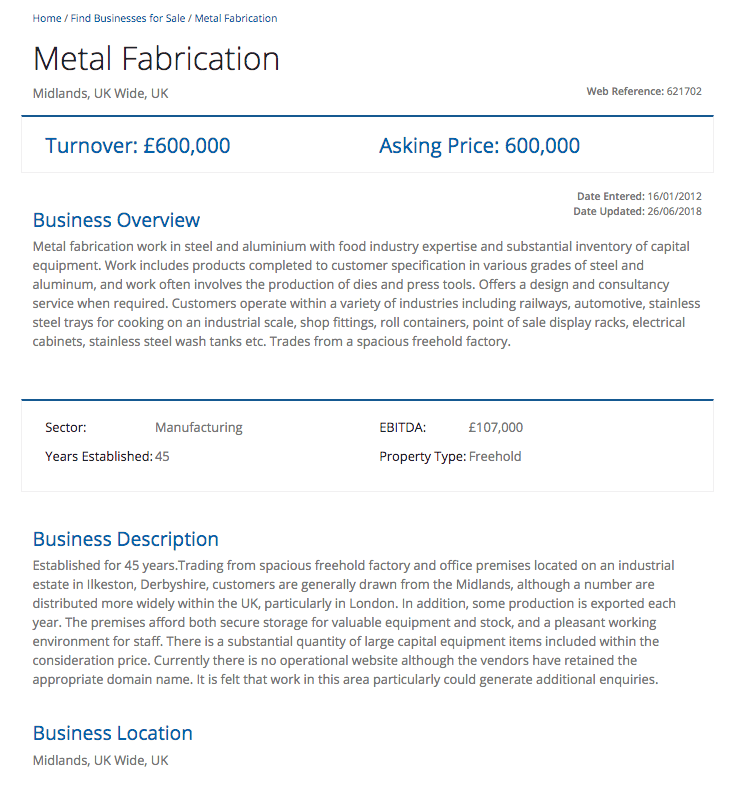

The first step to selling your business is setting a price, which advertises its worth to anyone looking to acquire. It is vital that the price you set is not too low nor too ambitious, as both can draw undesirable responses from potential purchasers. Enlist the services of a valuer with a financial background in the industry, who is likely to give you a fair assessment of your business in terms of its worth; this will encompass the value of your fixed assets, inventory, and a measure of goodwill to ensure that the asking price is a fair and representative one of your company’s abilities, and not simply as a measure against others in the sector as well.

An integral part of the sales process is that buyers will conduct due diligence into your business prior to purchase, to ensure they are making a worthy and sound investment before taking it over. Often an incredibly thorough investigation into your business’s affairs, it’s best to have your papers in order in advance and conduct your own due diligence, so as to avoid any unwanted surprises or shocks when affairs are handed over to prospective clients. Scrutinising your own accounts first will allow you to flag up pertinent issues and address problems before they threaten to reduce the value of your company from a buyer’s perspective.

Due to the detailed nature of these evaluations, you are also encouraged to create comprehensive non-disclosure agreements, so the privacy of your sale and its accounts are protected during the investigation and sales process by all the involved parties.

As the owner of a manufacturing business, however, these are the main areas that require closer attention:

The routine maintenance of equipment is a significant expenditure for most companies, but failing to invest regularly in the upkeep and proper functioning of your assets could lead to further issues down the line. Having equipment of the highest standard and quality, well-kept throughout the years and still as efficient as when it was first bought, will show potential buyers that your company is serious in terms of longevity and sustainability, which will in turn be reflected in profitability and income upon the company’s final sale.

Sustainability and longevity are not restricted to just the maintenance of hard assets, but should also be a key feature of a manufacturing company’s R&D department. A sale might be on the way, but this shouldn’t stop your company from trying to boost its innovation abilities - after all, this will show to your prospective buyer that even through transitional phases, the business’s objectives and goals remain unwavering. Put your company on an upward trajectory by ensuring a stream of new products meets market demands regularly, and avoid cutting corners just to make your company the first. Quality will always take precedence, and buyers will note this in their valuation of the company upon sale-time.

Evidence of manuals and organisational procedures, practices and systems will go a long way with buyers, simply because it will show them that a smooth transition is possible. There is nothing that irks and worries a potential acquirer more than the possibility that business will decline in a post-sale scenario. Giving them documentation of how to keep a business running once it has changed hands will offer them a level of comfort. This is likely to be looked upon favourably during price negotiations.

The environment is a growing matter of concern for businesses, and when interested parties are surveying the company for the sake of an acquisition, it is vital that you demonstrate that you are environmentally compliant.

For manufacturers, waste management and sustainability are two major factors to address, in addition to creating goods that are safe to operate and ethically produced. And though the ‘red tape’ can often appear to be a constraint on your abilities and access to resources, it is worthwhile having a team or department which deals with regulatory issues specifically. Not only will this show to buyers that you are willing to address compliance issues head-on, but also that the company is equipped to handle future issues with a specific team should they arise in the future.

The cost of being environmentally compliant and in line with industry regulation will pay off during the sales process, as acquirers will favourably view your business as a safer legal bet in comparison to those that may be cutting corners.

A Heads of Term agreement, often known as a Letter of Intent, will be drawn up once the due diligence process is complete, and a buyer still wants to go through with the purchase. In this document, the finer details of the sale will be outlined, including the capacity in which you will stay on in a post-sale scenario, and how you will continue to associate with the company in the future. The payment details will also be addressed in this document.

This agreement is particularly relevant as it sets the sale in stone and signals a period of transition to all employees, shareholders, and members on the executive board, not to mention clients and customers should news of the acquisition reach the media. Concerns may be raised over the potential changes to the goods being produced as a result of the sale, but a proper press release or a PR team to handle media requests should help you beneficially manage the reputation of the company further down the line.

Seeing through the sale of your business can be both exciting and exhausting, and in particular with manufacturing firms, there is plenty to assess prior to listing your company on the market. From setting the price of your business by valuing the cost of your hard assets, inventory, to ensuring the upward trajectory of your R&D department, and maintaining the ethics through strong regulatory compliance, it is vital to accommodate for the various aspects of the sales process specific to the manufacturing industry to pave the way for a successful and fruitful negotiation and exit strategy.

Not to worry you can list your first business for sale for free with Business Sale Report.

Looking to sell a small business for sale with a turnover of under £300k? Check out our sister site BizSale.co.uk

This could be your listing

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.