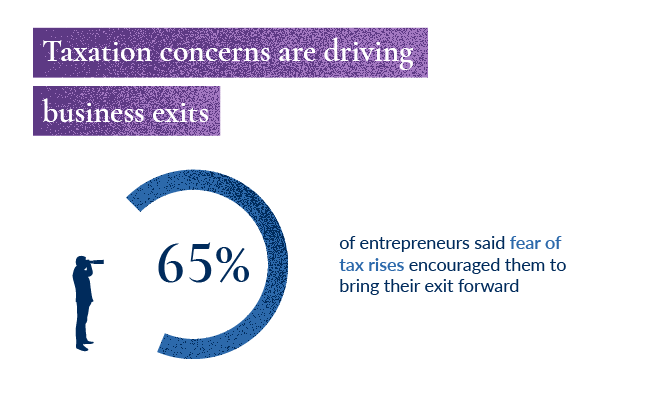

A new survey on motivations behind business sales has revealed that over half of entrepreneur respondents (56%) are considering an early business exit over concerns about tax rises. Of those who have already sold, nearly two-thirds (65%) said fear of tax hikes drove them to exit their business early.

The research, conducted by London-based private and commercial bank Arbuthnot Latham & Co, underscores the anxiety many founders feel in the face of changing tax policies - particularly in the wake of recent and upcoming changes to Business Asset Disposal Relief (BADR) and Investors' Relief.

Action steps for entrepreneurs

If you are concerned about tax and thinking about your exit, consider these immediate actions:

Start formal exit planning now. Engage experienced advisers - M&A specialists, tax planners, wealth managers - to map your optimal path.

- Benchmark your business readiness. Assess where value gaps exist and set up a 90-day sprint plan to start closing them.

- Align business and personal goals. Ensure that your personal financial planning (retirement, estate, philanthropic goals) matches your business strategy. Consult with a wealth planner well in advance for advice on how to plan, manage, and structure the personal wealth from an exit.

- Monitor tax policy developments. Stay informed, but avoid reactive decision-making based purely on tax fears.

This is an opportunity to acquire the shares, business and/or assets of an electrophoretic and powder coating specialist located within the North East of England. Indicative proposals, supported by proof of funding, are accepted by no later than 4pm...

This unique holiday accommodation business offers distinctive, design-led stays on over 15 acres of private land, complete with exceptional amenities and a residential property. With a strong occupancy rate of over 90% and excellent guest reviews, it...

FREEHOLD

This exceptional opportunity allows you to acquire a leading UK business in pneumatic tube systems for healthcare, boasting exclusive distribution rights and strong client retention through multi-year service agreements.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.