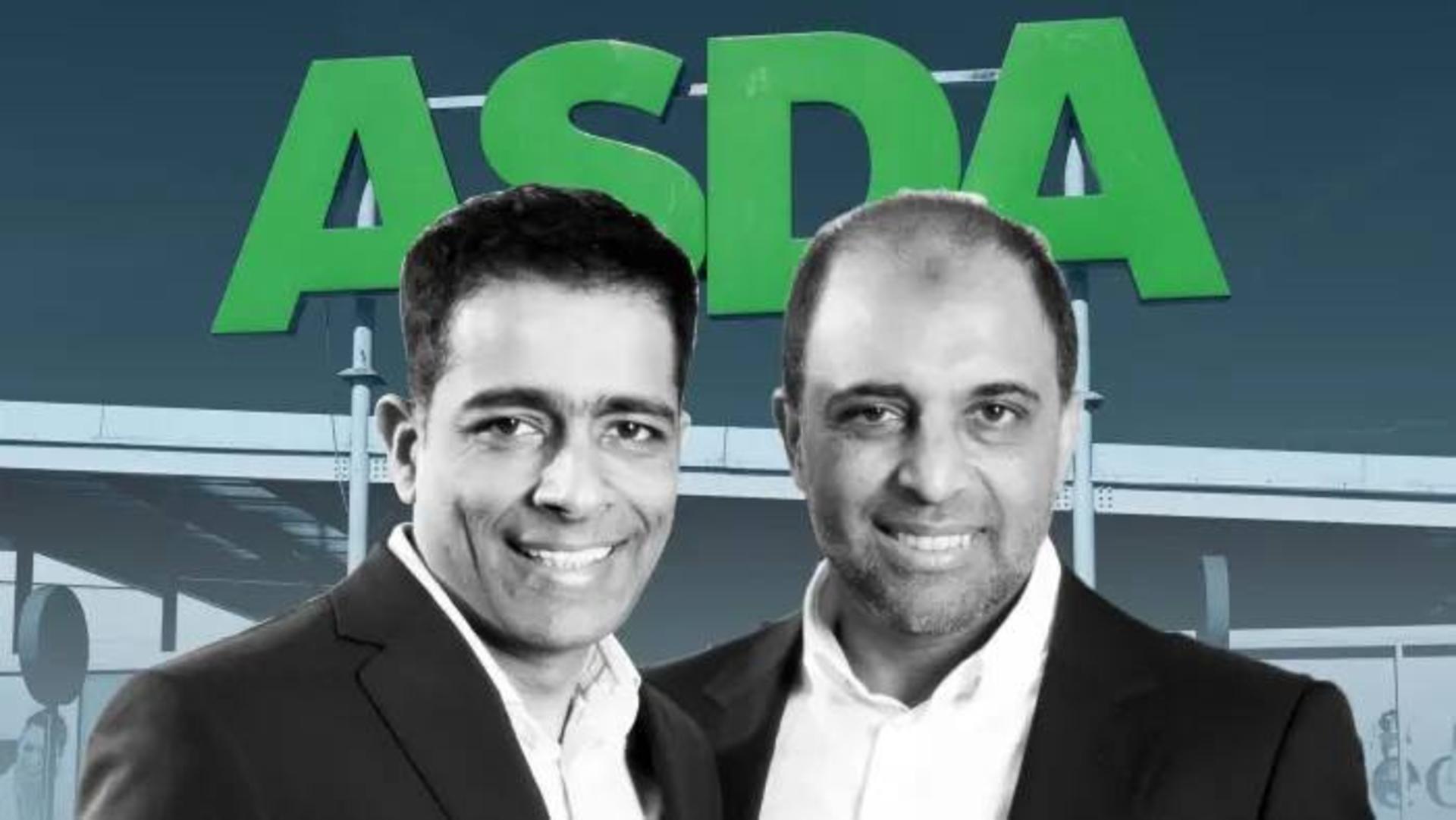

Brothers Mohsin and Zuber Issa and private equity firm TDR Capital are set to acquire the supermarket chain Asda in what will be the UK’s biggest leveraged takeover in more than a decade. The Issa Brothers and TDR Capital will pay just £780 million in cash for Asda, which is valued at £6.8 billion, with the majority to be funded by debt deals and asset disposals.

£3.7 billion will come from debt, due to be sold to investors later this month, while £1.7 billion will be raised through disposals of Asda assets, namely the sale and leaseback of distribution centres (£950 million) and the sale of the supermarket’s petrol stations to the Issa brothers’ EG Group (£750 million). On top of this, previous owner Walmart will retain a minority stake valued at £500 million.

Of the £780 million the new owners are putting forward themselves, much was likely generated last year when they raised hundreds of millions of pound selling preference shares – hybrid shares of both equity and debt – in EG Group’s offshore holding company.

While it is common for private equity-backed takeovers to be funded in large parts by debt, the Asda deal is a somewhat extreme example, with just 12 per cent of the purchase price coming via fresh equity from the new owners. To put this in perspective, according to S&P Global’s Leveraged Commentary & Data (LCD) index, European leveraged buyouts in 2020 had an average equity contribution of over 50 per cent.

The complex structure of the deal serves to minimise the risk that the Issa brothers and TDR Capital are exposing themselves to in acquiring Asda. However, for Asda, which previously had no external debts, adjusted EBITDA of £1.2 billion and freehold assets valued at nearly £3.5 billion, the deal now leaves it with over £3.4 billion in net debt.

In spite of the deal’s somewhat intricate structure, the Issa brothers have said that they are “putting in place a robust capital structure” for the supermarket chain and expressed their confidence “that external investors will share our belief in Asda’s strong fundamentals and exciting future prospects.”

The Issas added: "We look forward to working with our Asda colleagues to build an even stronger, more differentiated retailer - including through the investment of more than £1bn in the next three years to further strengthen the business and its supply chain.”

"We are also excited about the proposed integration of the Asda forecourts into EG's established UK operations, which we believe would underpin the future growth of the combined network."

Saddling a profitable company with this level of debt to fund a takeover is bound to prove controversial, with the deal still subject to Financial Conduct Authority approval as well as scrutiny from the Competition and Markets Authority, which blocked an attempted merger of Asda and Sainsbury’s last year.

On top of the new debt, there have also been suggestions that the asset disposals could also prove problematic for the company. While the sale of petrol forecourts and sale and leasebacks of distribution centres will generate capital in the here and now, the long-term upside of these decisions is questionable. Asda generates significant cashflow through its petrol stations, while sale and leasebacks could see the company tied into long, costly rental agreements.

Shore Capital Retail Analyst Clive Black said: “The risk profile of Asda has undoubtedly gone up. (…) They (the Issas) have bought Asda when supermarkets have got elevated sales and brighter general prospects as working from home and online groceries are probably here to stay. There is lots of money around and it is very cheap for risk-taking entrepreneurs and private equity but only time will tell whether they will look back and think that was a good thing to do.”

Despite the uncertainty, the Issa brothers and TDR Capital certainly seem to have acquired Asda at the right time, with the supermarket still owning significant property, boasting a solid market share and having continued to generate strong sales during the pandemic.

With the new owners promising to invest “more than £1 billion” in the business and its supply chain over the next three years (albeit through funds generated from Asda resources, rather than new cash), it could be that the takeover propels Asda to an even more elevated status at the centre of British supermarket retail.

But, with such a complex deal structure in place for this highly-leveraged takeover, Clive Black’s comment that “only time will tell” is perhaps the most apt assessment right now.

Find businesses for sale here.

If you are looking for an exit, we can help!

An established care and catering recruitment agency in Dorset is now available for sale, presenting a unique opportunity in a vital service sector.

Rutherglen is situated within South Lanarkshire, approximately 2 miles south east of Glasgow city centre. The town enjoys good access to the motorway network. It has a railway station that connects it to both Lanarkshire and Glasgow. International Ai...

LEASEHOLD

This directly authorised firm presents a unique opportunity, managing approximately £160 million of Funds under Management with a strong client base mainly around the M25.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.