With a huge number of businesses set to be impacted by this, from those with mounting piles of invoices they can’t pay, to those unable to collect payment on invoices owed, there is a likelihood of many companies being forced into a distressed scenario.

It seems likely that, as the economic impact of COVID-19 continues to unfold over the coming months, the problems caused by unpaid invoices for some will present opportunities for others. The next few months could present a prime marketplace for acquisitive parties looking to take on distressed businesses.

The situation

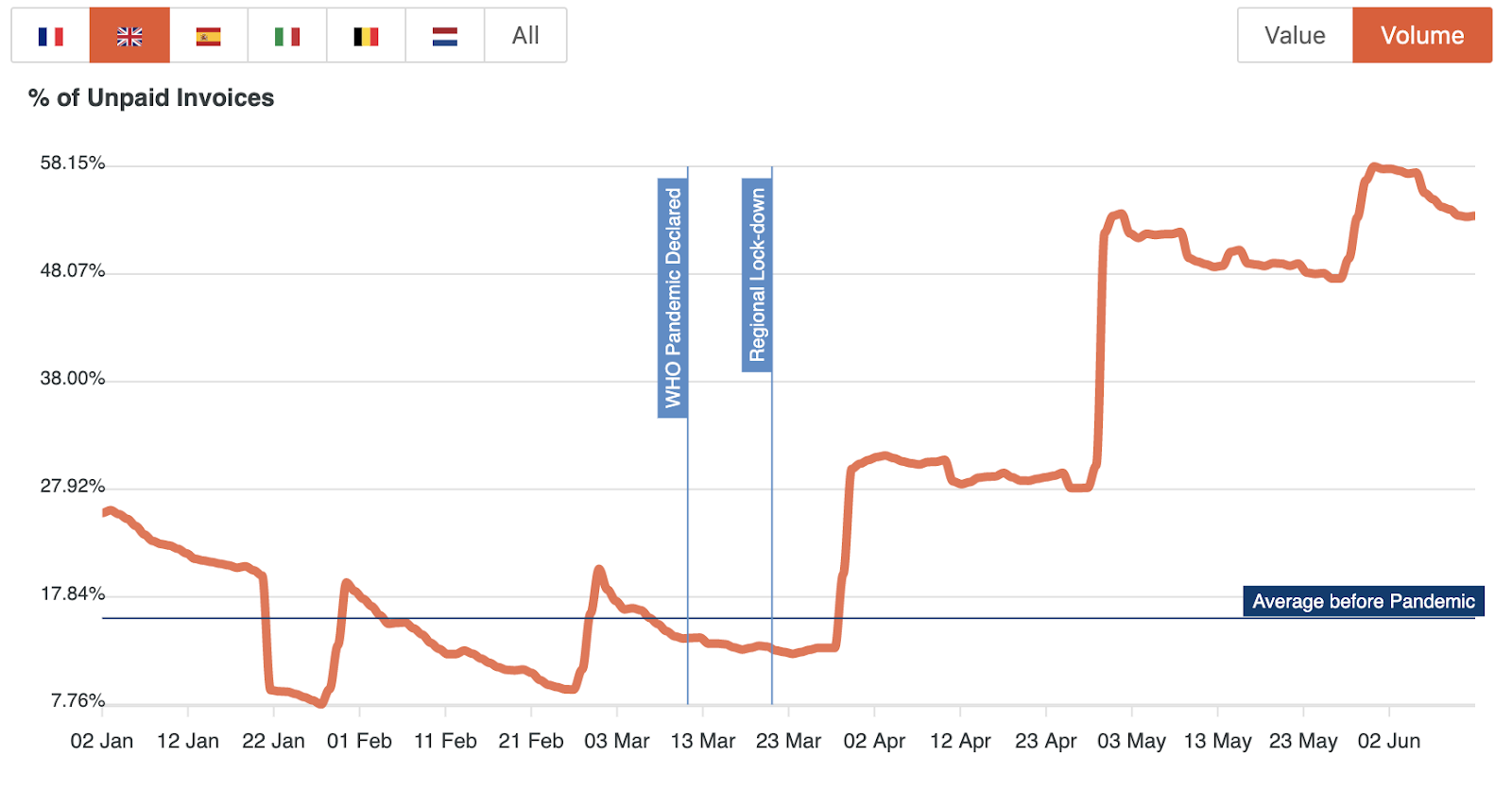

According to figures from Creditsafe’s late payment tracker, 61 per cent of all invoices paid in April 2020 were paid late, a 52 per cent increase from March 2020 and a 41 per cent leap from April 2019. This was especially felt in the transport, IT and real estate sectors, which saw significant increases.

Unpaid invoices remained an issue over the course of May. According to the Sidetrade invoice tracker, on June 13th 2020, 53.5 per cent of invoices by volume in the UK were unpaid, a 238 per cent increase on the average before the pandemic.

This is an opportunity to acquire the shares, business and/or assets of an electrophoretic and powder coating specialist located within the North East of England. Indicative proposals, supported by proof of funding, are accepted by no later than 4pm...

This unique holiday accommodation business offers distinctive, design-led stays on over 15 acres of private land, complete with exceptional amenities and a residential property. With a strong occupancy rate of over 90% and excellent guest reviews, it...

FREEHOLD

This exceptional opportunity allows you to acquire a leading UK business in pneumatic tube systems for healthcare, boasting exclusive distribution rights and strong client retention through multi-year service agreements.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.