Wed, 07 Feb 2024 | BUSINESS NEWS

UK M&A activity falls by almost a fifth in 2023, but cautious optimism grows as economic conditions stabilise.

• UK deal activity shows the Technology, Media and Telecommunications (TMT) sector saw the most activity for 2023

• Energy, Utilities and Resources saw the highest deal value

• PwC analysis shows that while the majority of UK deals in 2023 were led by corporates, the number of deals involving private equity reached its highest level at 42%

UK M&A activity in 2023 fell below the levels seen the previous year as economic headwinds continued to affect the number of deals completed in the year, according to PwC’s latest Global M&A Trends 2024 Outlook. However, activity for 2023 is still at pre-pandemic levels and as economic conditions ease, confidence is expected to return to the market.

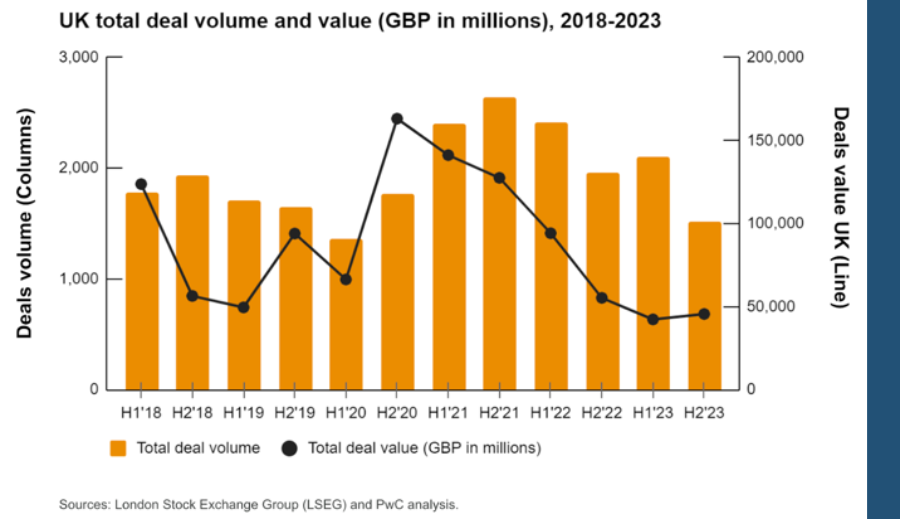

In total, the UK saw 3,628 deals across 2023, compared to 4,362 the previous year, a 17% decline, almost triple the rate of decline in global deals volumes of 6% over the same period. Further analysis shows a drop in deal volume during the second half of 2023 (H2 2023) of almost 600 deals compared to the first half of the year (H1 2023). The volume of activity seen in H2 2023 is the second lowest in the last five years, next to the first half of 2020 which was affected by a slump in dealmaking early in the pandemic.

There was a total of £46bn worth of UK deals in H2 2023 compared to £42bn in H1, bringing the total deal value for the year to £88bn. However, total deal value in 2023 was down 41% compared to almost £150bn worth of deals seen in 2022.

Lucy Stapleton, head of deals at PwC UK, said:

“While the macroeconomic environment is still challenging, overall, we are in a much better place than we were a year ago with inflation steadily falling and while interest rates are still higher than recent times, they have stabilised.

“There is still an appetite for deals - our recent CEO Survey shows more than half of UK CEOs expect to make at least one major acquisition in the next three years and that the UK is the top investment target for US CEOs, while also becoming an increasingly popular place to invest for Chinese businesses.

“We expect the most robust areas of the market, underpinned by societal megatrends, will continue to drive deal activity such as healthcare whilst the fast pace of developments in AI and net zero will be key drivers for dealmakers.”

Operating internationally, the company offers the development, hosting, and maintenance of electronic document management software. The business provides maintenance contracts, licences, installation, and training for its software.

This well-established business excels in resin floor installation and repairs, alongside additional services like stainless steel drainage installations, catering to diverse sectors including engineering, aerospace, and healthcare across South West E...

The companies supply an array of gases to suit various applications, with the group’s offering comprising all types of argon, oxygen, acetylene, nitrogen, carbon dioxide, refrigerant gases, propane and butane.

LEASEHOLD

|

15

|

|

Sep

|

Mears Group acquires housing compliance firm in £9.5m deal | BUSINESS SALE

Pennington Choices Group Limited (PCL), a social housing com...

|

15

|

|

Sep

|

Future of Bristol sheet metal fabricator secured with acquisition | BUSINESS SALE

A longstanding sheet metal fabricator based in Bristol has b...

|

15

|

|

Sep

|

Materials handling firm acquires furniture skate manufacturer | BUSINESS SALE

BIL Group, a Wiltshire-based manufacturer of materials handl...

|

01

|

|

Nov

|

Reaction Engines dives into administration | ADMINISTRATION

Oxfordshire-based aircraft firm Reaction Engines has crashed...

|

16

|

|

Oct

|

Furniture firm Plumbs finds comfort in pre-pack deal | ADMINISTRATION

A fourth-generation family furniture firm based in Lancashir...

|

27

|

|

Jan

|

Paperchase set to be rescued in pre-pack acquisition | BUSINESS SALE

High-street stationer Paperchase is set to be acquired by Pe...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.