Fri, 16 Aug 2024 | BUSINESS SALE

The Unseen Group, a Manchester based software company operating in the graduate careers industry, has completed its seventh acquisition. The group, which trades as GradTouch, has acquired North East company Evolve Assess.

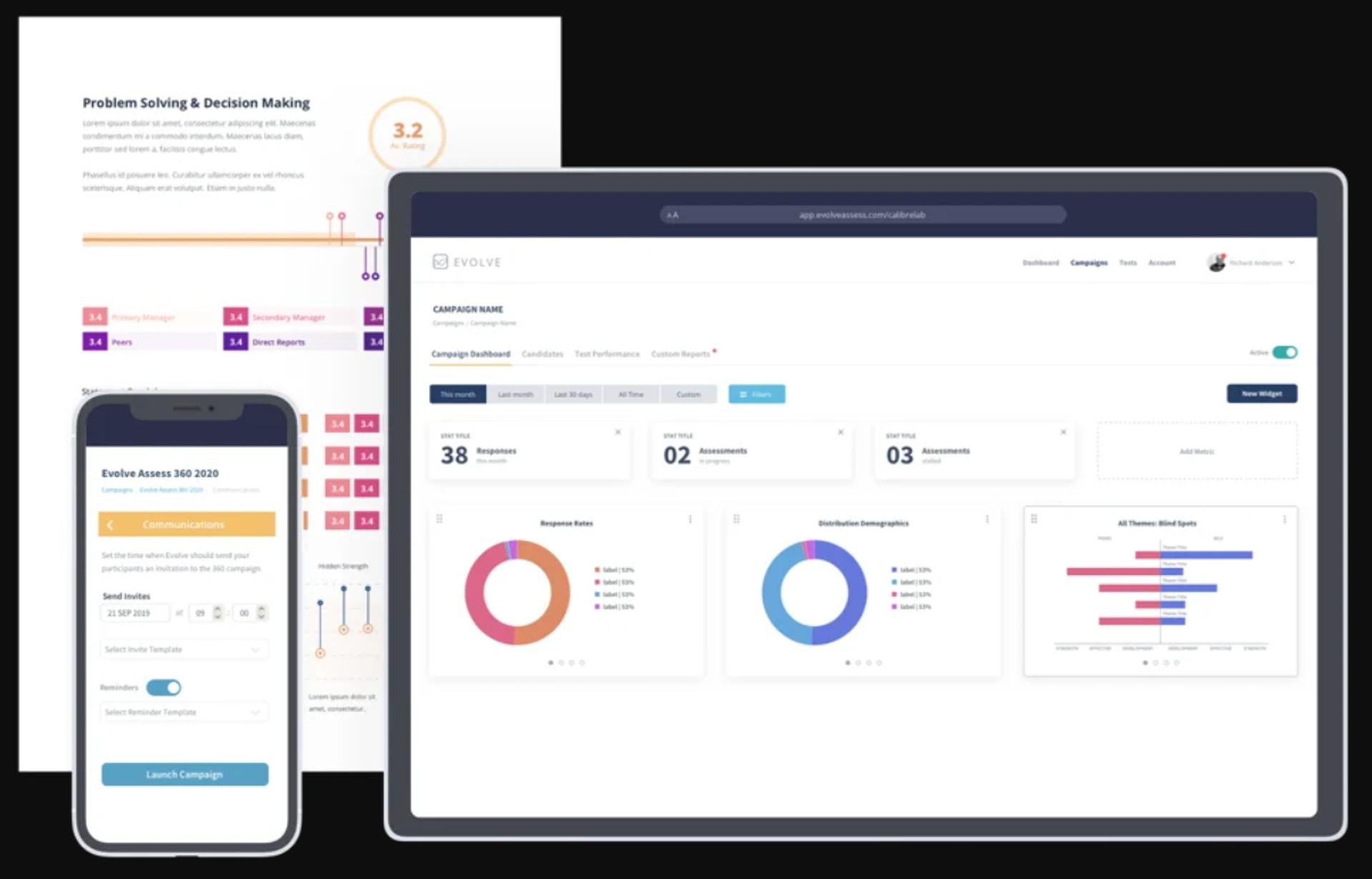

Founded in 2016, Evolve Assess provides psychometric assessments and candidate feedback, working with clients including NatWest Group and St James' Place. Following the acquisition, the company will work closely with Unseen Group business TopScore, a provider of digital assessment centre technology for large-scale employers.

Unseen Group Chief Executive Zac Williams called Evolve Assess “an amazing platform with a highly skilled team behind it”.

He continued: "As we grow as a group, we're dedicated to offering educators and employers a wider range of tools and services that all come together to ensure that no pathway goes unseen for the next generation of talent. Evolve Assess is a crucial piece of that puzzle."

Evolve Assess founder Richard Anderson said that the company would complement Unseen Group’s “growing list of products and services with our online test platform.”

He added: "This deal was a no-brainer for me, and I'm incredibly proud to now be a part of this thriving business. Joining a group of highly innovative and dynamic brands will only strengthen and grow the service we offer our clients."

The deal comes less than two months after Unseen Group secured fresh private equity backing, with Maven Capital exiting the business after seven years in June and the group receiving equity investment from Pelican Capital and a multi-million-pound acquisition facility from ThinCats.

The funding will enable the group to pursue acquisitions and accelerate its organic growth by further developing its product portfolio. Pelican Capital Investment Manager Elliot Vickerstaff said that, with Pelican’s backing, Unseen Group was “poised to create a market-leading platform in the early careers sector through a well-executed strategic buy-and-build approach."

Andrew Feeke, Head of Corporate Finance at MHA, which acted as lead corporate finance and tax advisor to Unseen Group, said it was “a fast-growing business in a fragmented and rapidly developing sector.”

Find out more about M&A trends in the UK professional services sector

Read about another recent Unseen Group acquisition

Operating internationally, the company offers the development, hosting, and maintenance of electronic document management software. The business provides maintenance contracts, licences, installation, and training for its software.

This rapidly growing wellness technology business, based in the West Midlands but operating nationwide, specialises in alternative therapy equipment for the burgeoning health, recovery, and longevity sectors.

Stock forecasting is a challenge for most companies, if inventory is not well managed the enterprise will face an increase in costs and even it can register losses. This stock management software solution provides an optimal forecast so that the ente...

|

15

|

|

Sep

|

Mears Group acquires housing compliance firm in £9.5m deal | BUSINESS SALE

Pennington Choices Group Limited (PCL), a social housing com...

|

15

|

|

Sep

|

Future of Bristol sheet metal fabricator secured with acquisition | BUSINESS SALE

A longstanding sheet metal fabricator based in Bristol has b...

|

15

|

|

Sep

|

Materials handling firm acquires furniture skate manufacturer | BUSINESS SALE

BIL Group, a Wiltshire-based manufacturer of materials handl...

|

17

|

|

Jun

|

PE-backed talent services firm completes tenth acquisition | BUSINESS SALE

The Unseen Group, a Manchester-based talent services company...

|

12

|

|

Nov

|

Unseen makes acquisition number 8 with Sten10 | BUSINESS SALE

Manchester-based Unseen Group has continued its expansion dr...

|

22

|

|

Jan

|

Employability services firm strikes sixth deal in buy-and-build strategy | BUSINESS SALE

Unseen Group, a software and employability services provider...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.