Thu, 17 Apr 2025 | BUSINESS SALE

Nutrition specialist Science in Sport (SiS) has agreed to be bought for £82 million by Einstein Bidco Limited, a newly formed company indirectly wholly-owned by funds advised by bd-capital Partners.

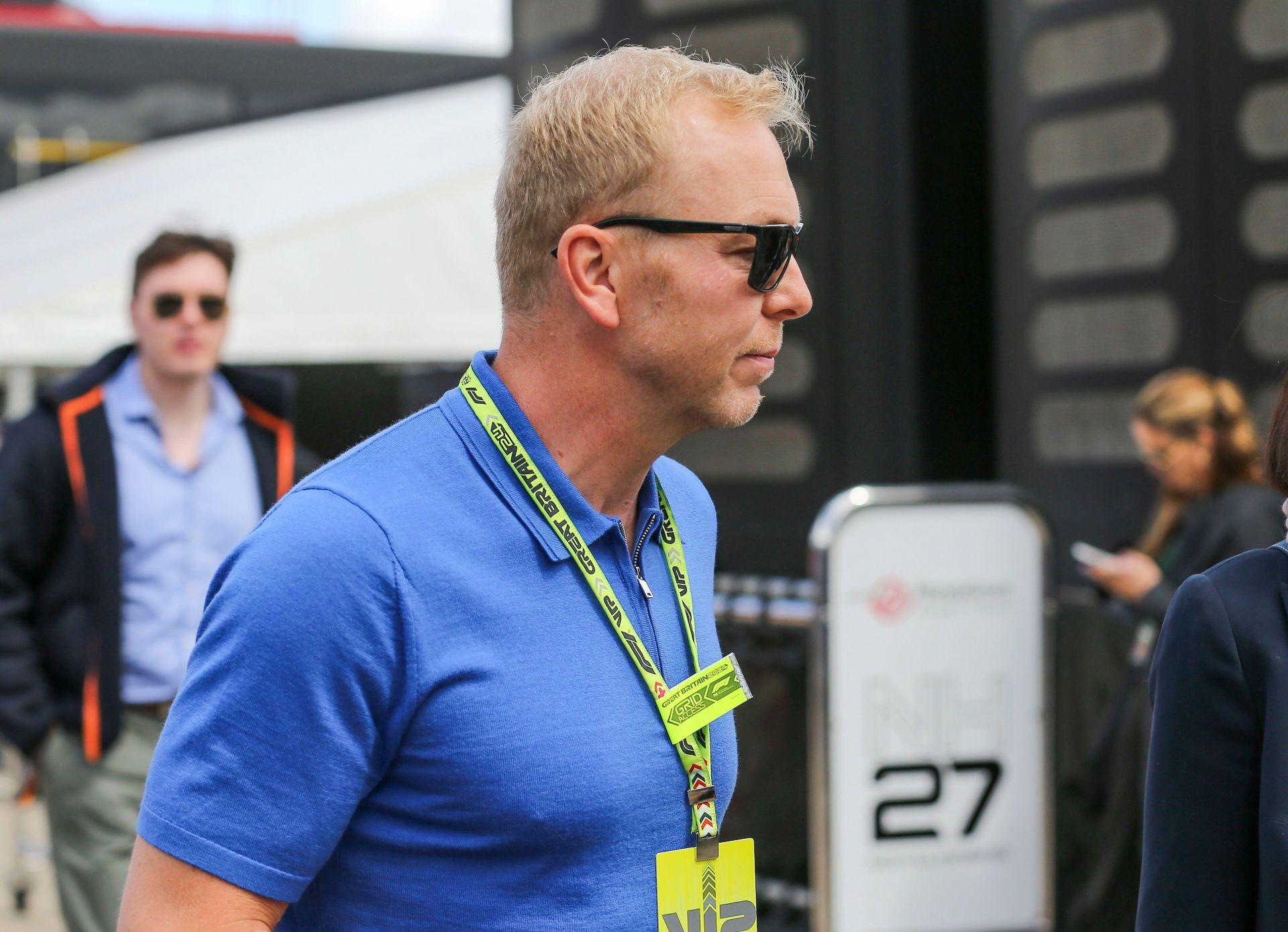

The listed SiS has two main brands including PhD Nutrition and SiS which is a performance nutrition partner to over 320 professional teams, organisations, and national teams worldwide. SiS supplies more than 150 professional football clubs in the UK, Europe, and the USA. Brand ambassadors include the former track cyclist Sir Chris Hoy, an eleven-time world champion and six-time Olympic champion, and Eilish McColgan, who won gold in the 2022 Commonwealth Games 10,000 metres.

It has its headquarters in London and a 160,000 square foot manufacturing and logistics hub in Blackburn.

In a statement, the board of directors of SIS noted the recent "rumour and speculations" and said that it has received an approach at a price of 34 pence per share from bd-capital which is an investment firm established by former Boots chief Richard Baker.

Andrew Dawson, managing partner of bd-capital said: "We are impressed by the attractive fundamentals and high growth potential of SiS' two brands, both operating in growing segments of the attractive sports nutrition market. We are particularly attracted to the science-led heritage of the company, with strong advocacy amongst elite athletes and a loyal consumer base - all of which provide it with solid foundations for growth in the UK and internationally."

Henry Turcan, non-executive director of SiS, said: "The SiS Board believes that the current offer reflects the premium nature of the SiS brands and market position which has been established and rewards shareholders for the faith and capital provided, most recently at the turnaround fundraising undertaken in July last year at a price of 17 pence per share.”

International law firm Addleshaw Goddard advised SIS on the deal.

Find out more about PE activity in 2025

Explore the potential of acquiring a well-established industrial automation and system integration firm located in Merseyside, offering a solid client base and a reputation for quality service.

This is an opportunity to acquire a long-established specialist bakery business, supplying major UK supermarkets and boasting a fully equipped production facility with a skilled workforce.

Doughrise offers a unique chance to take on a well-regarded food and beverage brand with over a decade of successful operations and a devoted customer following in the South-East.

|

16

|

|

Sep

|

Training provider to pursue acquisitions with new PE backing | BUSINESS NEWS

Inspiro Learning, a Doncaster-based independent training pro...

|

16

|

|

Sep

|

UK administrations update: September 9 - 15 | ADMINISTRATION

Since our last update, the following businesses have been co...

|

16

|

|

Sep

|

Nottingham pharmacy acquired by husband-and-wife team | COMMERCIAL PROPERTY

A pharmacy in Nottingham has been acquired by a husband-and-...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.