Heads of Terms (HoT), also known as heads of agreement, memorandum of understanding or letter of intent, is a document utilised early in an M&A deal to outline the key terms of the acquisition.

More than simply being just another document in the lengthy M&A process, however, Heads of Terms are vital to the early stages of a deal and can be used to a buyer’s advantage in numerous ways.What is a Heads of Terms agreement?

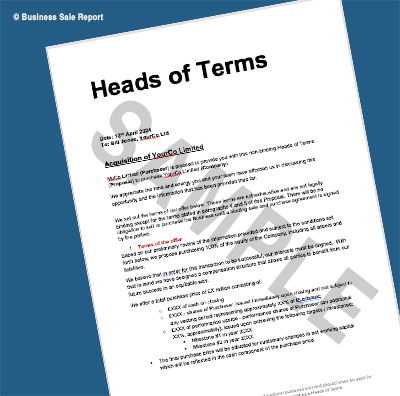

Speaking to BSR, Rishi Malliwal briefly summarised Heads of Terms agreements as typically being a two to four page document that sets out up to ten key terms of a deal. Heads of Terms are almost exclusively used in solvent deals, rather than in distressed acquisitions, which have shortened timeframes and in which the risks are readily apparent and balanced by the fact that the buyer is paying such a low consideration.Drawing up Heads of Terms

When buyers are preparing a Heads of Terms document, perhaps the key thing is to engage expert advice. Working with a professional, such as a lawyer or business advisor, will ensure that the document is structured correctly and is consistent throughout.What are the key advantages of using Heads of Terms?

Exclusivity

A rare chance to acquire a Midlands-based retail designer renowned for custom shop fittings and innovative design solutions, complete with in-house design and manufacturing capabilities.

This mixed dental practice offers a predominantly private service with the addition of NHS general and orthodontics contracts, benefiting from a large and loyal patient base as well as a thriving hygiene function.

LEASEHOLD

This is a reputable drainage solution company with a long-established presence and an excellent reputation in Somerset.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.