The story of Thrasio may not be long, but it is fascinating. The company was founded less than two years ago in Walpole, Massachusetts by entrepreneurs Joshua Silberstein and Carlos Cashman. Since the beginning, Thrasio has not only been profitable, it has been scaling up with ferocious pace.

The modus operandi of the business is to buy up Amazon FBA businesses. These are 3rd party private-label brands that use Amazon for fulfilment (FBA = fulfilment by Amazon). The products are manufactured by a third-party manufacturer and sold under the company’s own brand name.

According to John Hefter, Thrasio’s Director of Brand Strategy, “We’re the world’s largest acquirer of Amazon FBA businesses. We acquire about two to three businesses every single month. We scaled from zero to 25 brands in less than fifteen months.”

That was October 2019. True to John’s word, Thrasio has picked up another 18 businesses since then, making 43 acquisitions in total, all paid for outright in cash.

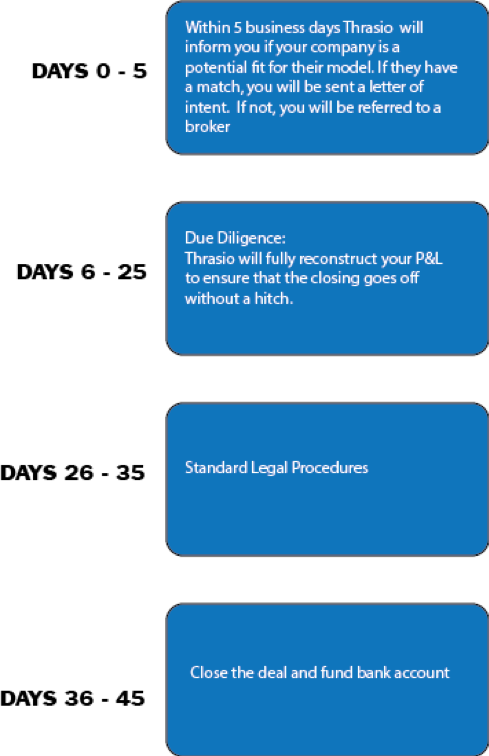

The acquisition process seems to be formulaic and slick. Says John, “communication is good between the seller, our diligence team, our legal team and overall the process is just streamlined”. We tracked down a couple of owners of businesses that had sold up to Thrasio.

Angry Orange, which sells pet odor removers, was one of the early deals. Owner Adam St. George was happy with how quick the process was: “The process from signing the purchase agreement to payout was just about three months.”

Another business bought by Thrasio with 100 per cent cash paid up-front was Flexguard Support, a backbrace seller. Owner Bert said, “We closed the deal from start to finish in six weeks, which was phenomenal”.

In a recent interview with Crunchbase, Thrasio co-owner Josh Silberstein said, “There’s not a lot of institutional buyers out there for companies with less than $5 million in profit. That’s where we come in. We make them millionaires and they can move on to something else if they want.”

This is a unique opportunity to acquire a well-established retail business in Leicestershire specialising in freshwater fish, including valuable stock such as Koi Carp and a range of related goods.

LEASEHOLD

This is a unique opportunity to acquire a well-established UK-based designer and manufacturer of high-quality modular building solutions, renowned for serving diverse sectors such as education, healthcare, and commercial industries.

An extraordinary opportunity to acquire a highly profitable independent catering butcher business in the north of England, renowned for its quality meats, poultry, and game supplied to a wide range of catering establishments.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.