When you make the decision to sell your business, undertaking a fresh growth strategy might not be the first thing that springs to mind. However, there are a number of reasons why you should aim to grow your company prior to a sale.

Of course, the most obvious reason is that larger companies with higher turnover and earnings command higher multiples than smaller businesses, meaning a more significant payday for you once a deal is completed. But that’s not the only reason.

As a business grows from, say, six-figure turnover to seven or eight-figures, it becomes easier to ultimately transfer control to a new owner. That might sound illogical, but there is solid evidence that growing a business can make the process of disposing of it far simpler, quicker and more cost-effective.

When a business is bigger, there are likely to be more solid, well-established processes in place, which makes it easier to transfer during a sale, compared to the more haphazard systems that are often in place at smaller, less well-developed companies.

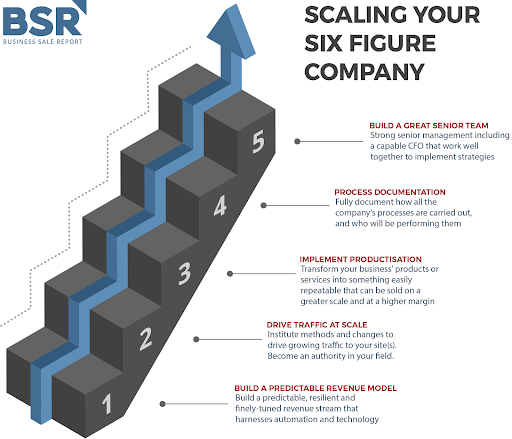

As a result, in order to unlock a higher sale multiple when it comes time to sell your business and to help ensure that it has efficient, set processes in place and is ready for a rapid, successful transition of ownership, here are some steps that you can take to scale your firm to a seven or eight-figure business.

This is a unique opportunity to acquire valuable intellectual property assets from a well-established wholesaler with many years of experience in the discount food and non-food sector in the Midlands.

This is an opportunity to acquire a long-established specialist bakery business, supplying major UK supermarkets and boasting a fully equipped production facility with a skilled workforce.

Discover the rare chance to acquire a specialist UK supplier of marine engines and generators, noted for their leadership in the used marine engine market and hard-to-find parts.

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.