Wed, 21 May 2025 | ADMINISTRATION

Manta Systems UK Limited, a North East-based supplier of modular remote and autonomous underwater vehicles to the subsea industry, has fallen into administration, with Gareth Harris and Lee Lockwood of RSM UK appointed as joint administrators.

Following their appointment, the joint administrators are seeking to realise the assets of the company on the best available terms in order to distribute funds to creditors, where possible, in the order of priority.

Manta Systems fell into administration at the end of April, approximately a year after the company was acquired by global marine services firm PXGEO, following several years of losses and a winding-up petition from Tompkins Investments.

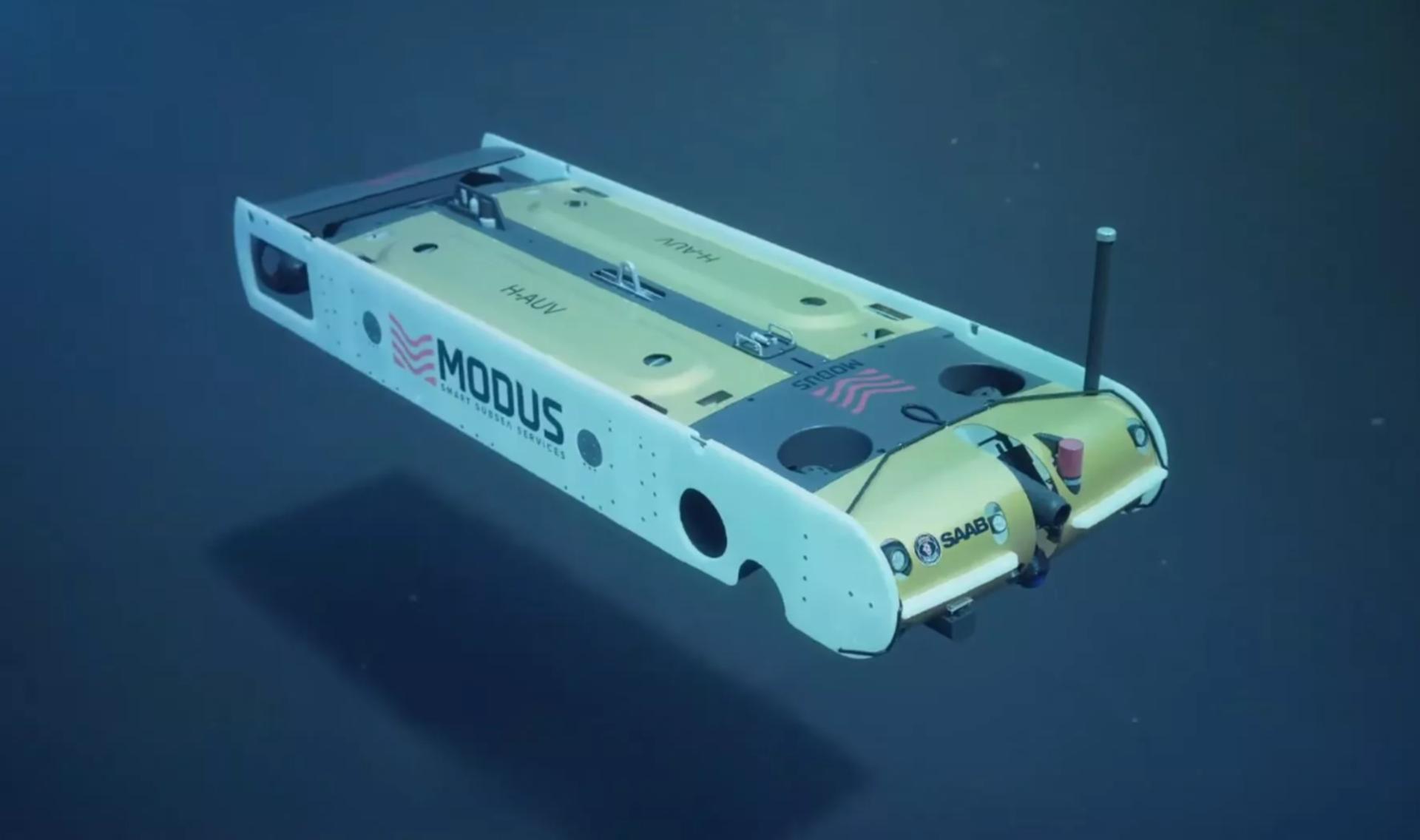

Previously trading as Modus Subsea Services before a name change in September 2024, the company had been operating for more than 35 years and specialised in autonomous subsea drones used in the oil and gas sectors.

The company has experienced a challenging few years, including a restructuring in 2022 which saw it sell a fleet of remotely operated vehicles (ROVs) in order to streamline its business to focus on underwater intervention drone development. That year, the company also reported an operating loss of £1.3 million and had net liabilities totalling more than £9.7 million.

Despite the restructuring, the £5 million sale of its ROV fleet and the company’s subsequent acquisition by PXGEO, Manta has continued to face challenges. A hunt for a rescue buyer failed earlier this year, resulting in the company’s collapse.

Joint administrator and RSM UK partner Gareth Harris commented: “As a result of sustained losses and a winding up petition, Manta Systems UK Limited had limited options available in the circumstances and unfortunately, a sale of the business as a whole was not possible.”

"It’s a very uncertain time for businesses and unfortunately the company faced several challenges which were exacerbated by the current economic climate and general market uncertainty. Following our appointment, we’re working closely with the company’s creditors and other stakeholders to realise assets identified and deal with creditor claims.”

To download the guide "How to Buy Distressed Assets and Businesses" and the practical "Steps to acquire a distressed business", please sign up to our newsletter.

Download the free report: A business buyer's guide to Intellectual Property considerations

This energy and ESG proptech provider offers an exciting opportunity to partner with a company poised for significant growth in the UK and EMEA region by transitioning to a SaaS model.

This well-established software development business, operating since 1999, is renowned for delivering custom solutions, including bespoke CRM systems and mobile apps, to a diverse clientele across sectors such as healthcare, retail, and public servic...

This rapidly growing UK-based auto glass replacement platform is a pioneer in digitising the industry, offering real-time quotes and seamless mobile scheduling to meet strong, recurring demand.

|

20

|

|

Aug

|

Digital banking giant Starling acquires London FinTech firm | BUSINESS SALE

Digital banking giant Starling has struck its first acquisit...

|

20

|

|

Aug

|

Engineering firm forms new group and makes acquisition after securing funding | BUSINESS SALE

Dyer Engineering Limited, an engineering firm based in Count...

|

19

|

|

Aug

|

Tiffin Sandwiches acquires food-to-go manufacturer | BUSINESS SALE

Convenience food supplier Tiffin Sandwiches has acquired foo...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.