Fri, 02 Apr 2021 | ADMINISTRATION

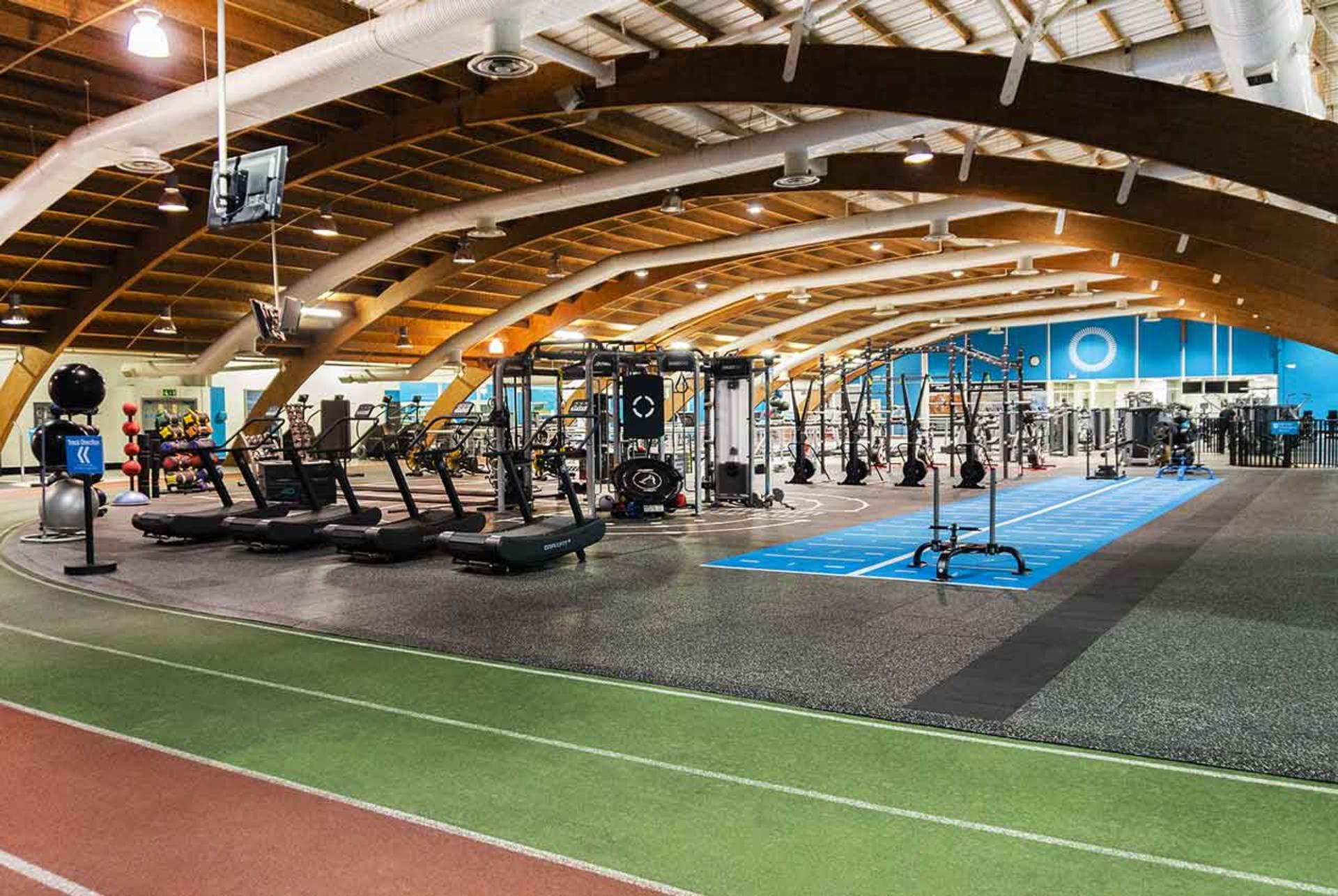

Total Fitness, a fitness group that owns 17 gyms across the north of England and Wales, has announced that it has entered into a company voluntary arrangement (CVA) after being severely impacted by COVID-19 lockdown restrictions.

The company, which will reopen all but one of its facilities, has appointed Tracey Pye and Richard Harrison of administration and advisory service KPMG to provide guidance as it seeks to avoid entering administration and explore its options moving forward.

In addition, a spokesperson revealed that Total Fitness has sought out the support of its suppliers and partners, including landlords, as it attempts to secure the future of the business.

The firm has blamed the COVID-19 pandemic for its financial issues, suggesting that it is facing similar problems to many other companies that have dealt with long-term closure as a result of lockdown restrictions.

"The COVID-19 crisis has been hugely challenging for many industries, particularly for those that have been closed for long periods of time, such as the fitness industry," the spokesperson added.

"Total Fitness is no exception to the impact of COVID-19 and is now seeking the assistance of all partners (landlords and suppliers) to support the strong, long-term future of the business by launching a CVA. We are being supported in this process by our owners and also by our advisors, KPMG."

Total Fitness first launched in 1993 on the Isle of Man but has since expanded across parts of England and Wales. Since June 2018 it has been headed by CEO Sophie Lawler. Commenting on the announcement, she said: "The cumulative effects of the lockdown restrictions have had a major impact on gym and health clubs across the UK.

"Total Fitness clubs have now been closed for eight months. With membership payments on pause, this means we are operating with very limited income and continuing costs."

View the latest distressed UK businesses here.

This is a unique opportunity to acquire a well-established online travel agency servicing the UK market, boasting significant intellectual property assets. The expedited sale process ensures a swift acquisition for interested parties.

This is a unique opportunity to invest in or acquire a professional football club with a legacy of 79 years, currently competing in the National League South.

This is an exciting opportunity to acquire a well-established 52-bedroom hotel in Montrose, located in an affluent area near the town centre and popular tourist attractions. The hotel benefits from a diverse clientele, including corporate and leisure...

FREEHOLD

|

12

|

|

Aug

|

Frasers Group acquires electronics retailer out of administration | BUSINESS SALE

Ebuyer (UK) Limited, an electronics retailer that fell into ...

|

12

|

|

Aug

|

Aquaculture services business falls into administration | ADMINISTRATION

Aqualife Services Limited, a Stirling-based aquaculture serv...

|

12

|

|

Aug

|

New IFA consolidator launches with first acquisition | BUSINESS SALE

Absolute Financial Group, a new private equity-backed indepe...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.