Mon, 12 May 2025 | ADMINISTRATION

A Bristol-headquartered subsea and offshore wind tech company which also had offices in Edinburgh and Aberdeenshire has fallen into administration. Beam was formed in September 2024 through the merger of offshore inspection systems business Rovco, which traded as Beam, and sister company Vaarst.

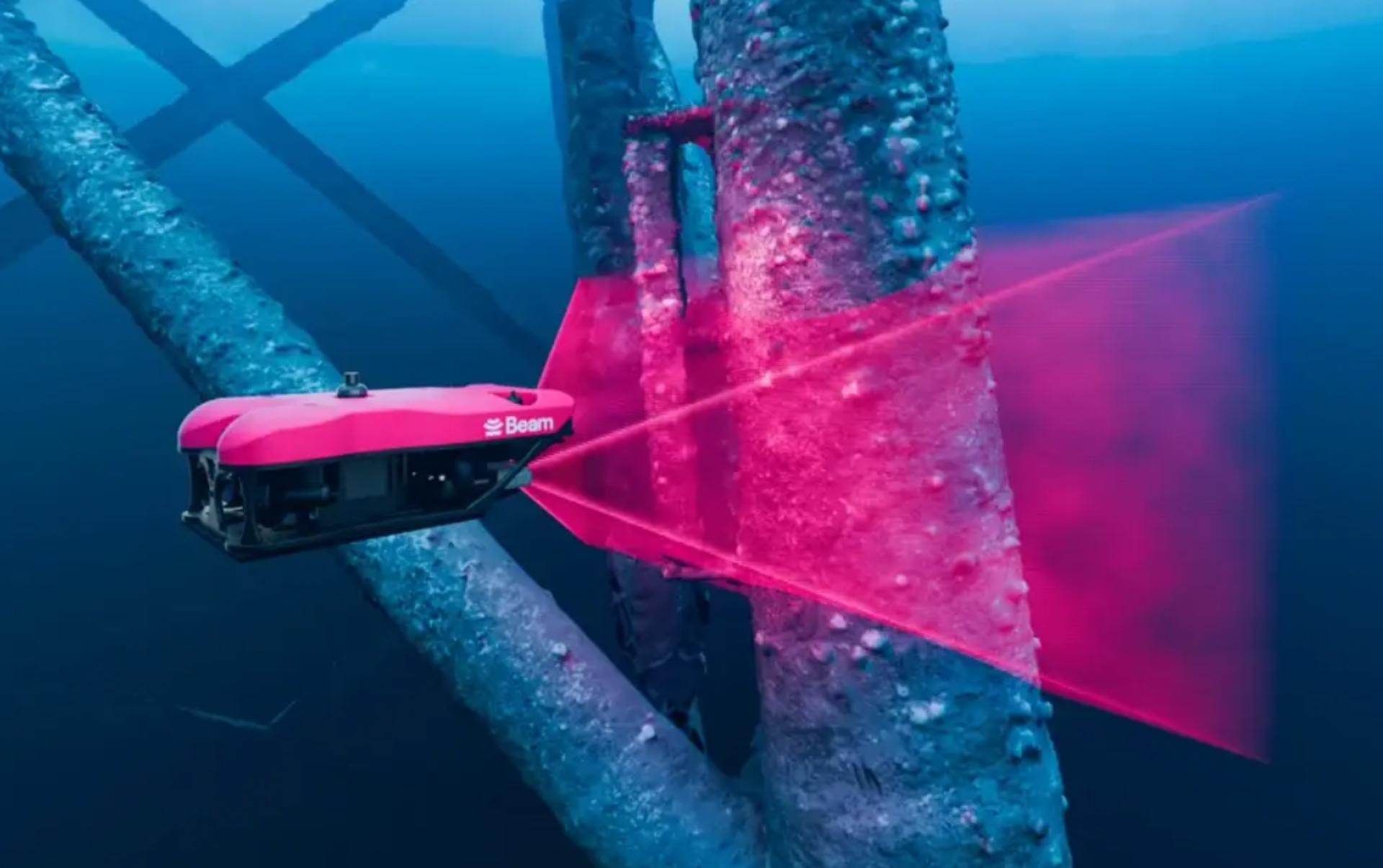

The company, which claimed to be a "leading deep technology company", utilised tools including underwater robots and AI to service offshore wind farms. Rovco and Vaarst developed and deployed AI and autonomy-enabled services for maintenance, repair and inspection work.

The company had operations across the UK and Irish seas, as well as in Europe, Japan and the US. It worked with a number of the world’s leading offshore wind operators.

When the two firms merged as Beam last year, the company announced plans to create 200 new jobs, including 50 roles in international locations such as the USA and Asia. At the time, the company said it aimed to grow by developing industry-leading innovations to increase efficiencies and cuts costs for survey and subsea work.

However, just eight months after the merger, the firm has now fallen into administration following an unsuccessful equity raise. David Shambrook and Damian Webb of RSM UK Restructuring Advisory have been appointed as joint administrators.

The administration, which also came in the wake of a failed effort to conduct an accelerated sale of the business and its assets in April 2025, sees around 162 of the company’s 195 staff made redundant.

The joint administrators are now exploring a range of options to maximise returns for creditors and, where possible, preserve jobs at the company.

In accounts for the year to December 31 2023, Rovco Limited, trading as Beam, reported turnover of around £19.6 million, up from £13.6 million a year earlier. However, the company fell to a loss of £8.1 million, having incurred losses of £8.7 million a year earlier.

At the time, the company’s fixed assets were valued at £6.5 million and current assets at around £5.7 million, with net assets amounting to £3.1 million.

UK corporate insolvencies are remaining high as companies struggle with a wide array of headwinds.

Acquiring robotics and automation capabilities can help businesses in sectors such as engineering adapt and thrive in the future.

For 25+ years, the business has been supplying, installing, and servicing compressed air systems for a wide range of business applications. Members of the British Compressed Air Society, registered to ISO9001 and Safe Contractor approved.

This is a unique opportunity to acquire a globally recognised, IP-led engineering company with over 100 patents in advanced materials, including graphene, and an accomplished leadership team with vast industry experience.

Discover a unique opportunity to acquire a well-established engineering business in Cheshire, specialising in precision CNC machined components for high-tech markets.

|

11

|

|

Aug

|

Engineering materials firm seeks accelerated sale of remaining assets | BUSINESS SALE

Listed advanced engineering materials company Versarien has ...

|

08

|

|

Aug

|

Former Shropshire care home up for sale for £450,000 | COMMERCIAL PROPERTY

A former care home in Shropshire has been put up for sale wi...

|

08

|

|

Aug

|

South West brass instruments manufacturer acquired by Italian firm | BUSINESS SALE

Denis Wick Products Limited, a South West-based manufacturer...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.