Fri, 03 Jun 2022 | BUSINESS NEWS

The latest edition of BDO’s Private Company Price Report Index (PCPI) has shown that deal volumes and average deal values declined from Q4 2021 to Q1 2022. However, there is still cause for optimism among dealmakers, with figures remaining strong despite a high degree of uncertainty and disruption at the start of 2022.

The PCPI tracks acquisitions of UK private companies by trade buyers and also features BDO’s Private Equity Price Index (PEPI) which tracks acquisitions of private companies by private equity buyers. The latest report showed that trade acquisitions had average multiples of 10.7x in the first quarter (compared to 11.4x in the previous quarter), while private equity multiples stood at 11.8x (down from 12.1x).

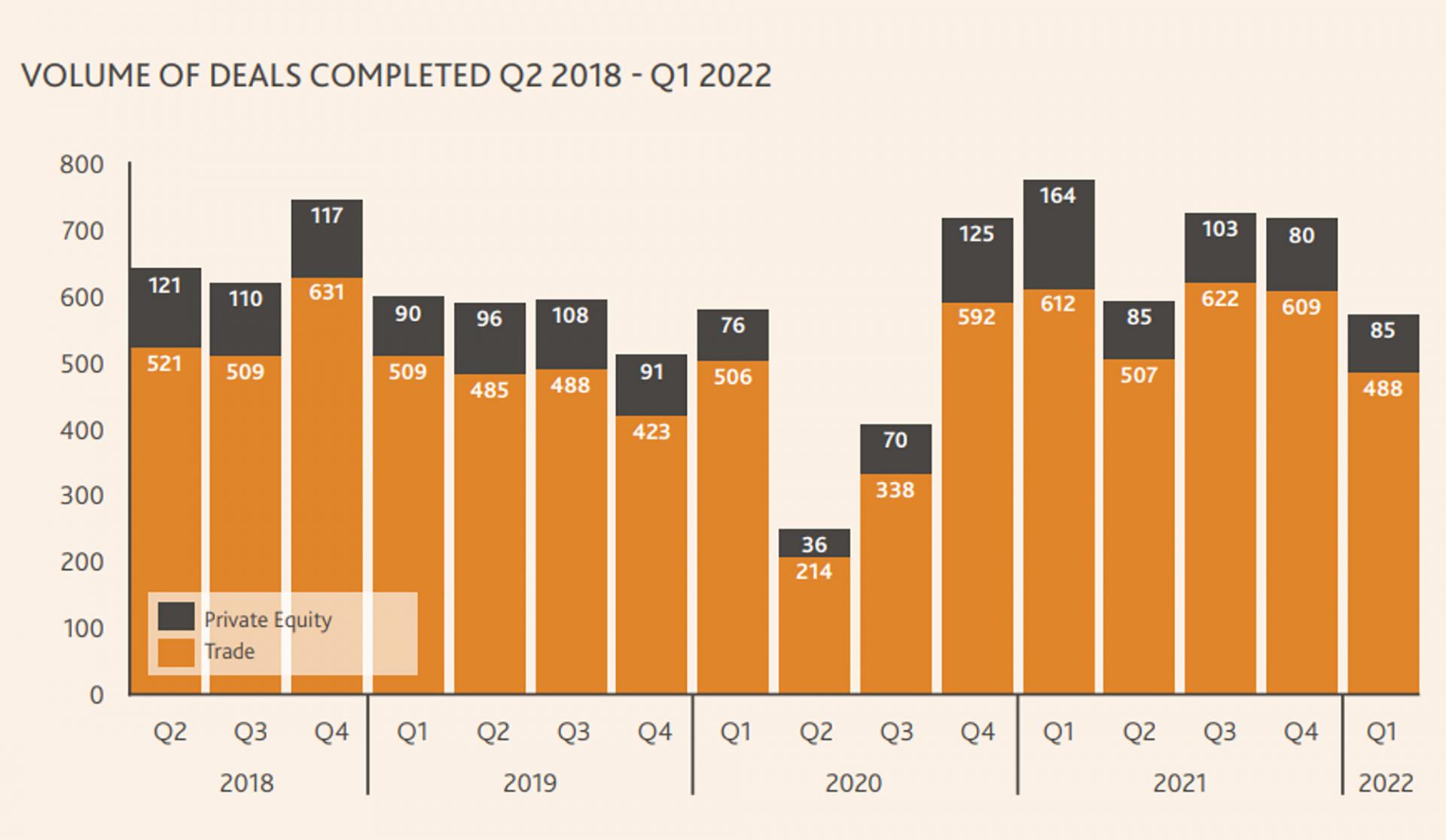

Overall, the PCPI tracked 573 acquisitions by trade and private equity buyers in the first quarter, down 16.8 per cent from 689 deals in Q4 2021. However, BDO has stated that this still demonstrates the strength of the M&A market, with deal volumes still remaining at pre-pandemic levels in Q1 despite global uncertainty, such as supply chain issues and the war in Ukraine.

There were more causes for optimism within the deal volume figures, with March recording the highest number of deals and private equity transactions actually rising slightly from 80 in Q4 2021 to 85 in Q1 2022. Overall, the decline seems to have been driven by a drop in trade activity, which BDO’s M&A Partner Roger Buckley called “not surprising”. According to Buckley, 2021’s high deal volumes represented a post-COVID “catch-up” in M&A activity.

Buckley commented: “It is not surprising to see a simmering down in volumes following the catch-up activity that took place last year. So far, indications are that the ‘new normal’ is looking very much like the old normal, despite considerable uncertainties across the economic and geo-political spectrum.”

“It is notable that March saw activity levels step up despite the invasion of Ukraine. UK business leaders have proven highly resilient and have cash to spend, meaning the outlook for M&A remains strong.”

To read more about how the PCPI works, as well as for further BSR analysis on what the figures mean and the prospects for dealmaking moving forward, read our insight on the latest report: M&A volumes in UK back to pre-pandemic levels.

Find businesses for sale here.

If you are looking for an exit, we can help!

This is a unique opportunity to acquire valuable intellectual property assets from a well-established wholesaler with many years of experience in the discount food and non-food sector in the Midlands.

This is an opportunity to acquire a long-established specialist bakery business, supplying major UK supermarkets and boasting a fully equipped production facility with a skilled workforce.

Discover the rare chance to acquire a specialist UK supplier of marine engines and generators, noted for their leadership in the used marine engine market and hard-to-find parts.

|

17

|

|

Sep

|

Construction materials firm acquires civil engineering contractor | BUSINESS SALE

Fox Brothers Holdings, a private equity-backed construction ...

|

17

|

|

Sep

|

Assets and IP of non-HFSS bakery brand set to be sold in pre-pack deal | ADMINISTRATION

Urban Legend, a healthier sweet bakery brand, is poised to e...

|

17

|

|

Sep

|

Regional care home operator expands with double acquisition | BUSINESS SALE

Regional care home operator Maven Healthcare has expanded wi...

|

17

|

|

Sep

|

West Midlands manufacturer to target M&A under new CEO | BUSINESS NEWS

PP Control & Automation (PP C&A), a West Midlands-based manu...

|

17

|

|

Sep

|

Regional care home operator expands with double acquisition | BUSINESS SALE

Regional care home operator Maven Healthcare has expanded wi...

|

17

|

|

Sep

|

Assets and IP of non-HFSS bakery brand set to be sold in pre-pack deal | ADMINISTRATION

Urban Legend, a healthier sweet bakery brand, is poised to e...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.