Fri, 06 Jan 2017 | BUSINESS SALE

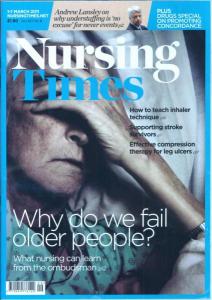

Fashion industry mag Drapers and nursing profession title Nursing Times are among a stable of magazines put on the market by their owner Ascential.

The publisher, once better-known as Emap, is to offload 13 titles as it focuses on bigger brands. It will keep just one print asset, Retail Week.

In a statement Ascential said it had separated a group of ‘heritage brands’ into a separate business while new buyers are sought.

The titles up for sale include Drapers, Nursing Times, Construction News, Heating and Ventilation News, Local Government Chronicle, New Civil Engineer and the Architectural Review.

In total the 13 titles made £63 million in revenue last year and about £10 million in operating profit.

Duncan Painter, Ascential chief executive officer, said: "Ascential's growth strategy continues to be to focus its resources and investment on its largest brands and those with the highest growth potential.

“Our top five products represented 56 per cent of group revenue and 71 per cent of adjusted EBITDA in the 12 months to 30 June 2016. This move will further focus our portfolio on our largest market-leading products.

“The heritage brands, with large, loyal audience communities, provide an exciting opportunity for new owners.”

See media businesses for sale.

This well-established facilities management business in London, specialising in cleaning, maintenance, and security services, offers a unique opportunity with multi-year service agreements ensuring predictable recurring income. This opportunity prese...

This thriving value added meat company, prominently featured in major retailers like Tesco and Sainsbury's, boasts impressive growth with sales projected to more than double by 2026. The business has shown remarkable growth and we are poised to incre...

This London-based health and beauty dropshipping store presents a remarkable opportunity with its fully responsive website, a strong emphasis on eco-friendly products, and a mission to protect bees, setting it apart in the market. The sale of the bus...

|

26

|

|

Aug

|

Redcentric discussing sale of data centre business | DIVISION SALE

IT managed services provider (MSP) Redcentric has announced ...

|

26

|

|

Aug

|

West Midlands law firm to target M&A with new funding | BUSINESS NEWS

A law firm based in the West Midlands is set to target growt...

|

26

|

|

Aug

|

UK administrations update: August 19 - 26 | ADMINISTRATION

Since our last update, the following businesses have been co...

|

15

|

|

Apr

|

UK events organiser on the market | BUSINESS SALE

FC Business Intelligence, which organises events around the ...

|

27

|

|

Feb

|

Cannes organiser Ascential to sell exhibitions arm | DIVISION SALE

Ascential, the company that runs many of the world’s l...

|

28

|

|

Mar

|

Emap considers sale of CAP | BUSINESS SALE

Used car data provider CAP looks set to be sold by its paren...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.