Wed, 03 Jun 2015 | BUSINESS SALE

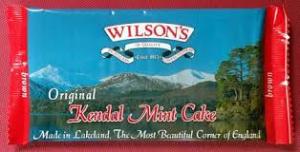

Cumbrian business JE Wilson & Sons, best known for manufacturing the mountaineers' favourite, Kendal Mint Cake, has been bought out of administration.

JE Wilson & Sons entered administration on 22 May this year following financial instability that came about after a relocation to a 40,000 square foot custom-built premises.

The company was bought out of administration on the same day by Creative Confectionery, lead by managing director Andrew Wilson, who is apparently one of JE Wilson's grandchildren. The deal has now gone through and the businesses are looking forward to a productive future.

Bibby Financial Services operated as a third party investor in helping secure the deal between JE Wilson & Sons and Creative Confectionery.

Mr Wilson commented on the deal: “I'm delighted to have secured the jobs of so many hardworking and committed people, and to have preserved the future of a third-generation family firm.

“Our new partners have exceptional experience in the food industry, and have made a huge success of all that they do. We can learn a lot from them as our business develops.”

Chris Farnworth, corporate manager with Bibby, added that his group worked with Wilson's to “deliver an adaptable funding structure” in order to stabilise the business, allow the deal to progress and “ensure that this quintessentially British business and maker of the famous Kendal Mint Cake lives on”.

If you have ever considered buying a distressed business or otherwise consider reading more about the financing options available to you as a business buyer.

This unique and renowned freehold bar and restaurant in the heart of York City Centre offers over 250 covers across its spacious interior, pavement seating, and a rare rooftop terrace.

FREEHOLD

A well established and strongly profitable engineering business, located in the Midlands. The company will be an attractive acquisition for both a larger trade buyer and also those looking for a stable engineering business.

This European pharmacy manufacturer specialises in providing custom clinical trial batches for leading pharmacy companies across the continent, playing a crucial role in their R&D efforts.

|

15

|

|

Aug

|

North East compliance services firm secures investment and new acquisition | BUSINESS SALE

ABCA Systems, a North East-based fire, security and electric...

|

15

|

|

Aug

|

Furniture delivery firm that had ceased trading enters administration | ADMINISTRATION

A Yorkshire-based logistics business that specialised in fur...

|

15

|

|

Aug

|

North Yorkshire food supplier secures future with sale | BUSINESS SALE

The future of a North Yorkshire-based meat and vegetable sup...

|

22

|

|

Feb

|

Modular Group acquires Euramax Solutions with BFS backing | BUSINESS SALE

Modular Group Investments has acquired Barnsley-based window...

|

06

|

|

May

|

Conviviality Retail buys 26 Rhythm and Booze stores | DIVISION SALE

Conviviality Retail is to purchase 26 Rhythm and Booze store...

|

02

|

|

Nov

|

HMRC debts pushed haulage company into administration | ADMINISTRATION

A haulage company has been pushed into administration by its...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.