Wed, 10 Jul 2019 | BUSINESS SALE

Park Sheet Metal Company (PSM) has been taken over by investment giant Rubicon Partners in its 74th acquisition deal in more than 25 years of experience and operations.

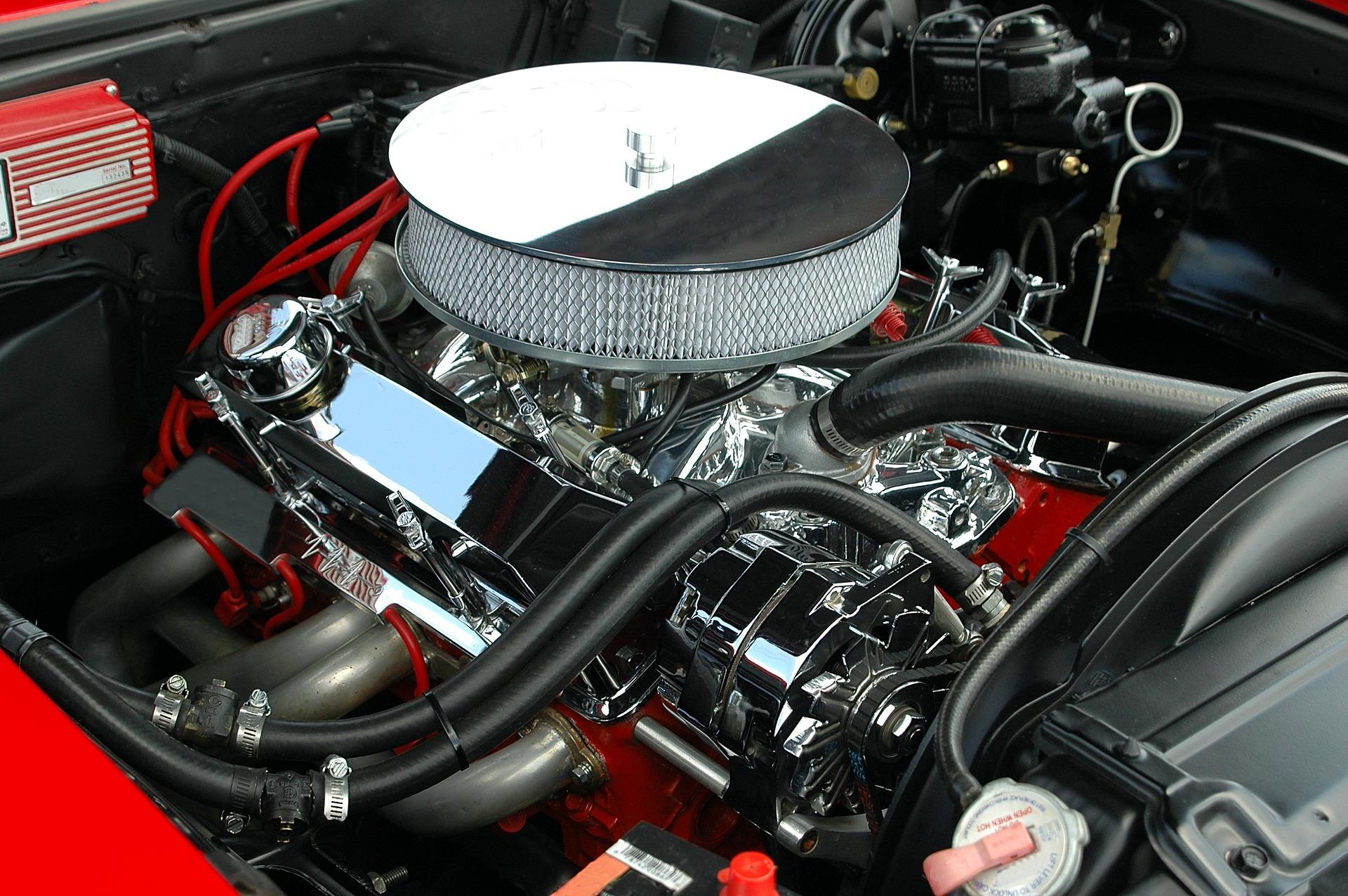

The manufacturing firm, headquartered in Coventry with roughly 250 members of staff across its five sites, and one that provides services to clients like Aston Martin, Bentley, and Jaguar Land Rover, was best known for its development of components used in prototype and production assemblies.

EY’s Birmingham corporate finance team advised PSM on the deal and sale to London-based Rubicon Partners.

PSM’s most recent accounts on Companies House revealed a turnover of £12.2 million in the year ending 31 January 2018, and a pre-tax profit of £781,000.

Mark Barge, previously the managing director of Rubicon Partners’ performance products division of Ricardo, has been appointed as PSM’s new chief executive.

The previous owner of PSM, and current managing director, Stephen Payne, said: “Rubicon Partners are committed to further developing and investing in PSM, having already signed off on additional plant, equipment and facilities to support planned growth. I would like to thank the EY team for all their support and advice.”

Anthony Edwards from EY’s Midlands Mergers & Acquisitions division, added: “PSM has a rich heritage of partnering with some of the UK’s leading automotive manufacturers.

“EY have worked hard to find the right buyer for the business and in Rubicon Partners have found an investor with extensive experience and a strong commitment to develop and invest in the future.”

This is an opportunity to acquire a long-established specialist bakery business, supplying major UK supermarkets and boasting a fully equipped production facility with a skilled workforce.

This well-established plastic injection moulding business offers a rare opportunity to acquire a company with years of industry experience, technical expertise, and a strong reputation across diverse sectors.

A leading bespoke joinery manufacturer specialising in high-end residential projects, delivering exceptional craftsmanship and innovative design.

|

17

|

|

Sep

|

Construction materials firm acquires civil engineering contractor | BUSINESS SALE

Fox Brothers Holdings, a private equity-backed construction ...

|

17

|

|

Sep

|

Assets and IP of non-HFSS bakery brand set to be sold in pre-pack deal | ADMINISTRATION

Urban Legend, a healthier sweet bakery brand, is poised to e...

|

17

|

|

Sep

|

Regional care home operator expands with double acquisition | BUSINESS SALE

Regional care home operator Maven Healthcare has expanded wi...

|

16

|

|

Jul

|

Farsound Aviation sold to AGIC for £115 million | BUSINESS SALE

A supply chain management company operating in the aviation ...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.