Thu, 21 Aug 2025 | BUSINESS SALE

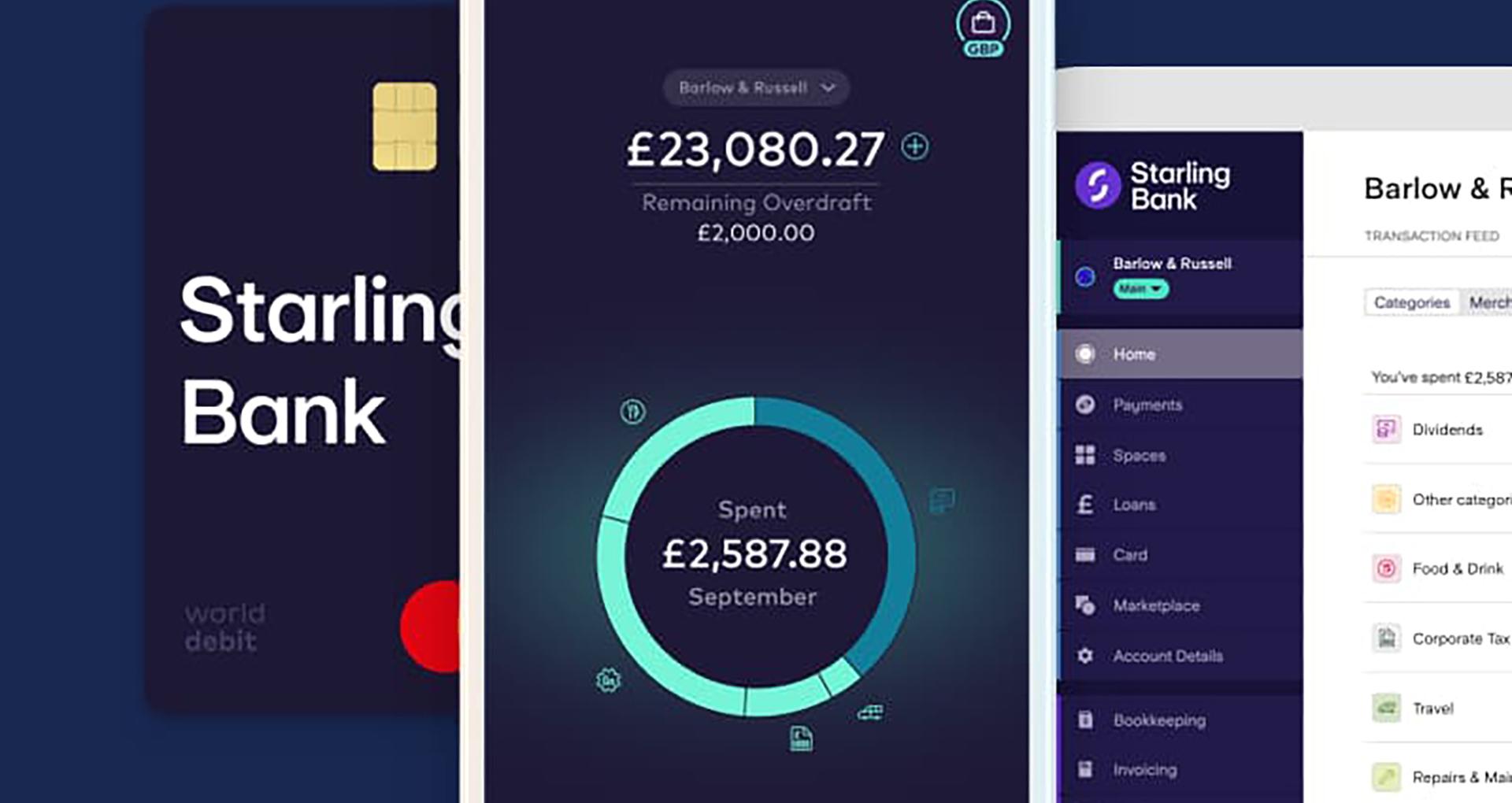

London based Starling Bank has acquired a UK fintech company, Ember, to enhance its services for small businesses. This move aims to expand Starling's offerings in the small business sector, where it currently holds a 9 per cent market share. The acquisition includes integrating Ember's tax and bookkeeping software into Starling's app and online banking platform. Ember's software is HMRC-recognised and will become exclusive to Starling, replacing its current providers like HSBC, Revolut, Barclays, and Lloyds.

Declan Ferguson, Group Chief Financial Officer, Starling Group, said: “We are a natural fintech consolidator, so targeted acquisitions like Ember will form a key part of our strategy as we continue to develop Starling Bank in the UK and Engine by Starling overseas. Just as Fleet Mortgages has flourished since we bought it in 2021, I’m confident that Ember’s best-in-class tools will become a fantastic addition to Starling Bank’s offering.”

This move aligns with a trend where neobanks are increasingly focusing on small business banking, especially as traditional banks have reduced their involvement in this area.

The British Business Bank reported that challenger banks now account for approximately 60 per cent of gross lending to small and medium-sized enterprises (SMEs), a significant increase from nearly two decades ago when the four largest banks dominated with 90 per cent of SME lending. However, recent data from UK Finance indicates that high street banks are re-entering the SME lending market, with loans to small businesses reaching £4.6 billion in the first quarter of 2025, marking a 14 per cent year-on-year increase.

Starling's acquisition of Ember also reflects a broader trend among UK fintechs to diversify their revenue streams. For instance, Monzo is exploring plans to offer mobile phone services, following in the footsteps of rivals Revolut and Klarna.

Find businesses for sale here.

If you are looking for an exit, we can help!

This is a unique opportunity to acquire a 50% shareholding in a boutique legal firm that provides cutting-edge tech support to the insurance sector, particularly in the Managing General Agent market.

This well-established West Midlands IFA, managing £200m in funds under management, offers a highly profitable client base with an average household value exceeding £400k.

An exclusive opportunity to acquire a prestigious ultra-high-net-worth independent financial advisory business in Kent, managing £70m in funds under management.

|

21

|

|

Aug

|

Mindler acquires UK telecare services division of Ieso Digital Health | DIVISION SALE

Swedish digital therapy company Mindler has acquired the UK ...

|

21

|

|

Aug

|

Starling Bank has acquired UK fintech company Ember | BUSINESS SALE

London based Starling Bank has acquired a UK fintech company...

|

21

|

|

Aug

|

Premier Tech buys two businesses to expands services in wastewater treatment | BUSINESS SALE

Wastewater treatment company Premier Tech has recently expan...

|

20

|

|

Aug

|

Digital banking giant Starling acquires London FinTech firm | BUSINESS SALE

Digital banking giant Starling has struck its first acquisit...

|

27

|

|

Apr

|

Starling Bank grows acquisition war chest after fundraising | BUSINESS NEWS

Digital bank Starling has raised £130.5 million in a f...

|

28

|

|

Jul

|

Starling Bank makes debut acquisition with £50m Fleet Mortgages takeover | BUSINESS SALE

Starling Bank has made its first acquisition, with a £...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.