Fri, 28 Apr 2023 | BUSINESS SALE

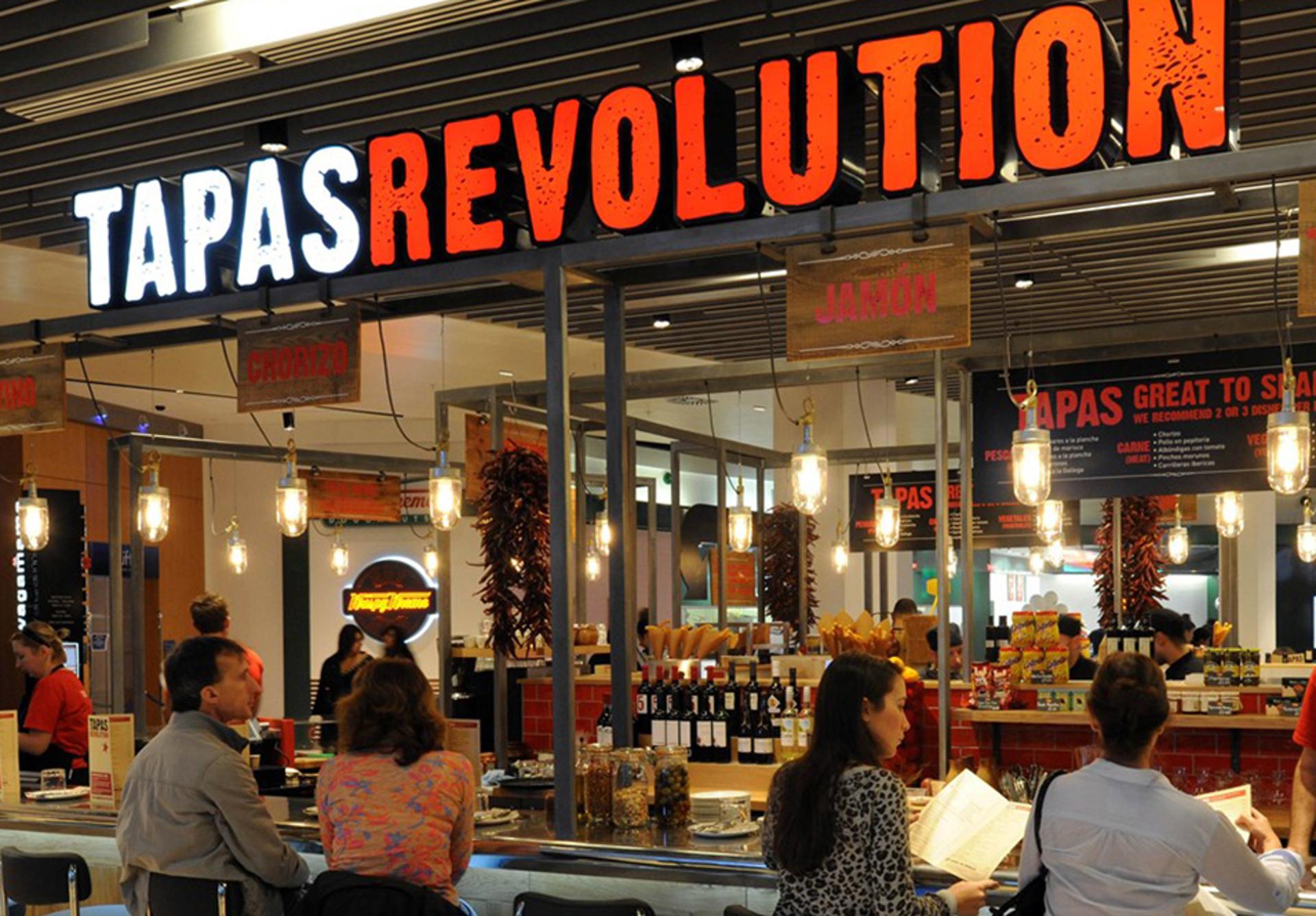

Restaurant chain Tapas Revolution has been sold in a pre-pack deal after falling into administration earlier this month. The business and its assets have been acquired by Tapas Bidco, a new firm led by James Picton, who was formerly a managing director at Tapas Revolution's parent company, Spanish Restaurant Group.

The company was founded in 2010 with a location at Westfield Shepherd’s Bush in London and expanded to 11 UK locations. In 2020, the company entered a joint-venture partnership with Spanish Restaurant Company and, that same year, acquired the La Tasca chain. La Tasca’s restaurants were subsequently rebranded as Tapas Revolution sites.

However, the chain was one of many restaurant operators to see its cashflow seriously impacted by the COVID-19 pandemic, with restaurants forced to close for much of 2020 and then subject to social distancing rules that limited their capacity.

More recently, the company has been hit by a drop in consumer confidence amid the ongoing cost of living crisis and has also seen its energy bills rise by around 300 per cent. As a result, RG Insolvency’s Avner Radomsky and Simon Renshaw were appointed as joint administrators to Spanish Restaurant Group on April 5 2023.

In a statement on Companies House, the administrators said: "Initial pandemic exhausted the reserves, leaving the business weak in terms of cashflow and balance sheets and has more recently been impacted by the costs of living crisis, which has seen turnover fall significantly, costs increase due to the inflation levels and the significant rise in energy pricing which has risen over 300%."

The joint administrators subsequently secured a sale of the business and its assets to Tapas Bidco for £235,000. The restaurants are not operated by Spanish Restaurant Group, with the parent company only owning the equity in its subsidiaries, meaning that the sale should not impact restaurant operations.

In Spanish Restaurant Group’s accounts to the year ending October 31 2021, its fixed assets were valued at £300,971 and current assets at £2.4 million. At the time, the group’s net liabilities amounted to £1.75 million.

Find out more about COVID-19's impact on fast casual dining in the UK.

Read about the headwinds currently impacting UK hospitality firms.

View recent administrations.

A bustling pub in Pontefract, West Yorkshire, presents a unique opportunity with potential for building development.

FREEHOLD

A well-known and much loved entertainment venue which is the central hub of this seaside town community on the Durham coast. Located between Sunderland and Durham this town boasts beautiful beaches and a thriving and rapidly expanding community.

FREEHOLD

A rare opportunity to acquire a highly successful and well-established restaurant near the historic Hampton Court Palace.

LEASEHOLD

|

15

|

|

Sep

|

Future of Bristol sheet metal fabricator secured with acquisition | BUSINESS SALE

A longstanding sheet metal fabricator based in Bristol has b...

|

15

|

|

Sep

|

Materials handling firm acquires furniture skate manufacturer | BUSINESS SALE

BIL Group, a Wiltshire-based manufacturer of materials handl...

|

12

|

|

Sep

|

Leeds care home operator sold to new owner | BUSINESS SALE

Bond UK Limited, the company behind two care homes in Leeds,...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.