Sat, 08 Dec 2018 | MBO/MBI

A geotechnical consulting group based in Durham has successfully completed a management buyout by two of its senior leadership team members, financially supported by HSBC UK.

Arc Environmental, considered to be one of the largest of its kind in the North East of England, has been taken over by Darren McGrath and John Ditchburn – two of the company’s associate directors who have been with the business since 2005.

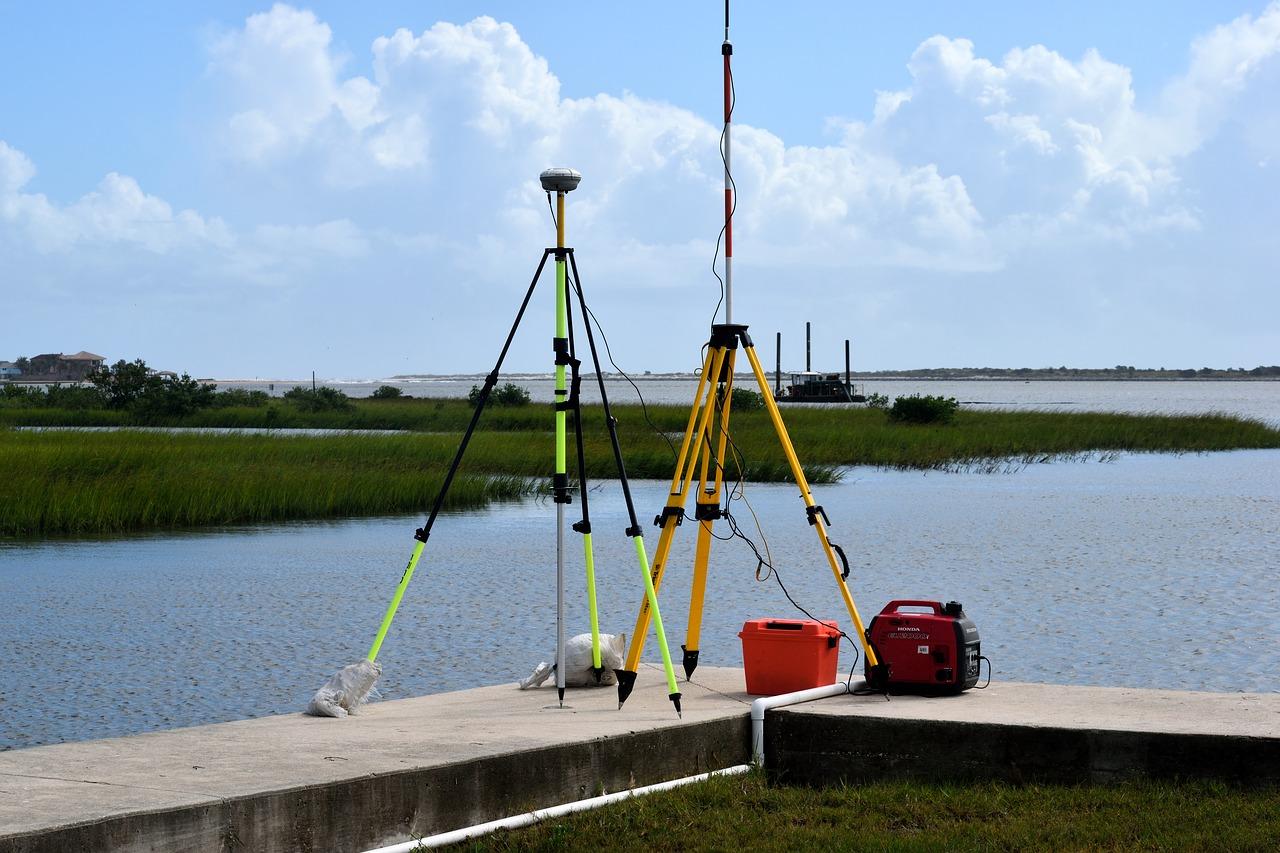

The environmental consultancy operates across the country providing its customers with a range of services, including site investigation and land remediation and validation.

Ditchburn said: “We have a strong, loyal team at Arc and this deal means the business continues to be owned by people who have been with it from the outset. The team has a wide range of specialist skills and expertise, working in partnership with clients including major engineering groups, contractors and government departments.

"The future is very positive, and our increased workload has led to the creation of a number of positions within the business, offering opportunities for experienced engineers to join the company at a very exciting time."

The MBO was advised by Clive Owen and Endeavour Partnership, whilst investment came from HSBC UK.

Corporate finance partner at Clive Owen, Angus Allan, further commented: “We are proud to have supported Darren and John on this transaction, advising on all financial aspects that have led to the successful conclusion of the MBO. The entrepreneurial endeavours of John and Darren will undoubtedly take Arc from strength to strength."

For more news about management buyouts (MBO), click here. For all our business listings, click here.

This is a unique opportunity to acquire a well-established recruitment business operating from leasehold premises in the South of England, featuring a consistently growing turnover with significant assets including office furniture, IT equipment, and...

This well-established car sales and garage business in Nottinghamshire offers a superb reputation supported by positive online reviews and occupies a prominent position on a main road in Worksop.

This exclusive Highland accommodation management business offers an exceptional opportunity to acquire a market leader in luxury self-catering apartment services within a historic estate in the Scottish Highlands.

|

17

|

|

Sep

|

Construction materials firm acquires civil engineering contractor | BUSINESS SALE

Fox Brothers Holdings, a private equity-backed construction ...

|

17

|

|

Sep

|

Assets and IP of non-HFSS bakery brand set to be sold in pre-pack deal | ADMINISTRATION

Urban Legend, a healthier sweet bakery brand, is poised to e...

|

17

|

|

Sep

|

Regional care home operator expands with double acquisition | BUSINESS SALE

Regional care home operator Maven Healthcare has expanded wi...

|

28

|

|

Jul

|

Law firm Ward Hadaway merges with Teesside counterpart | MERGER

Leeds-based law firm Ward Hadaway has merged with Teesside-b...

|

21

|

|

Feb

|

Edinburgh IT group Purview buys Australian peer EDF Systems | BUSINESS SALE

An Edinburgh-based IT managed services company has beefed up...

|

21

|

|

Nov

|

Omega Plastics in management buy-out | MBO/MBI

Gateshead-based plastics group Omega Plastics Group has unde...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.