Mon, 02 Dec 2024 | MBO/MBI

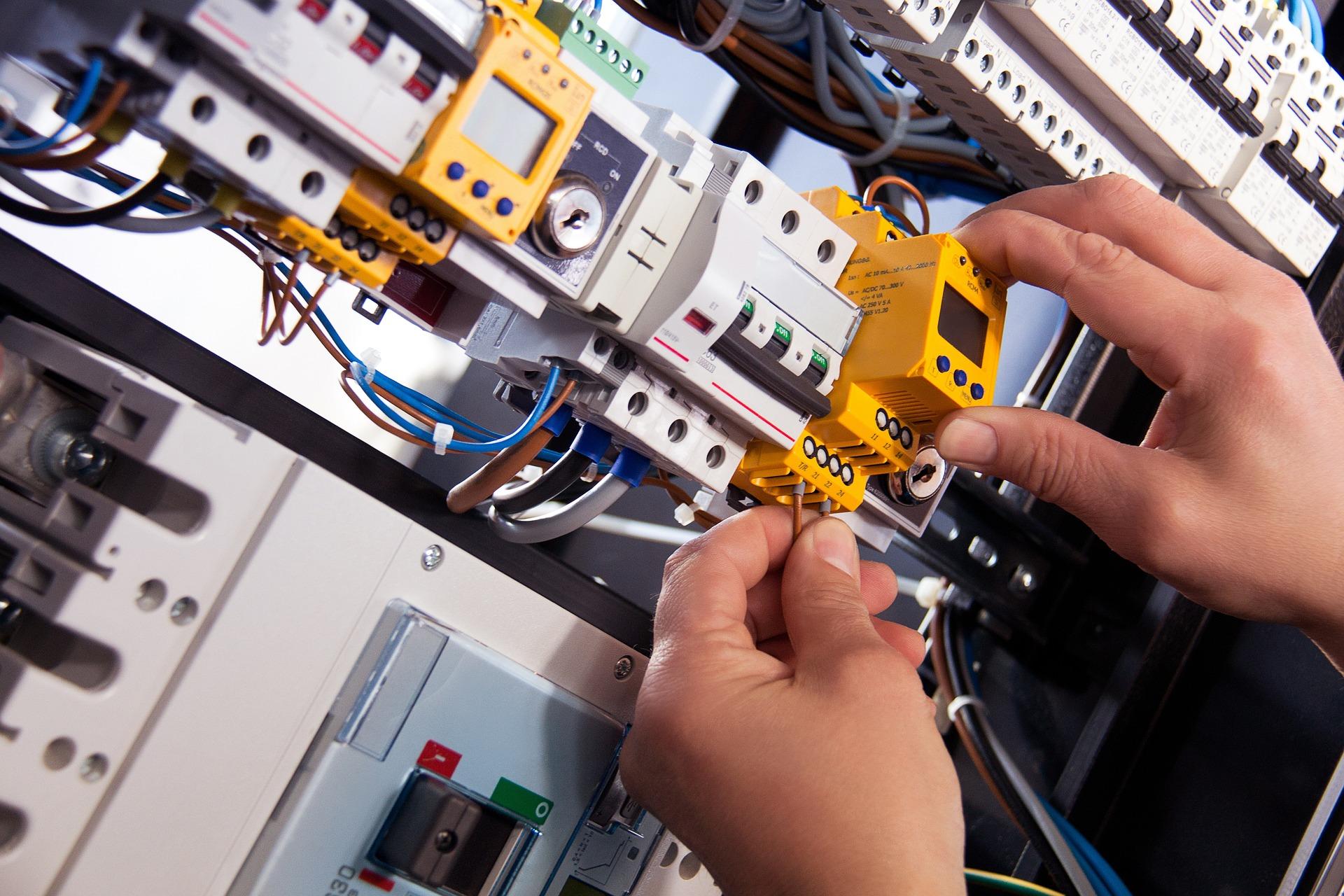

The founder of a Liverpool-based mechanical and electrical engineering company has sold the business to his management team.

Steven Hunt founded Steven A Hunt & Associates in 1989 providing engineering services to clients, project leaders, architects and consultant partners.

Its client base spans healthcare, education and the commercial sectors, including according to its website Liverpool Football Club and the NHS.

Boosted by a £500,000 investment from River Capital, the senior management team, comprising Neil Baines, Anne King, Dave Kelly and Dominic Sibbring, have acquired 79 per cent of the business from Hunt. He will remain with the company in a consultancy capacity, providing continued support.

The funding package included debt and vendor deferment, with the debt funding coming from the River Capital managed North West Business Growth Loan fund.

Baines and his fellow directors bought 21 per cent of the company last year when Hunt handed over the day-to-day running of the business.

Baines, managing director, said: "River Capital's investment enables us to complete a carefully planned succession and provides the financial foundation for the next chapter in our company's journey. With an increasing focus on sustainability across our key sectors of healthcare and education, we see tremendous opportunities ahead to design high-performing buildings that enhance wellbeing while minimising environmental impact.”

Jim Moore, investment manager at River Capital, said: "We are delighted to support the highly experienced management team at Steven A Hunt & Associates in this MBO. The company has demonstrated a consistent track record of profitability and is well-positioned for future growth. With the new leadership team's complementary skills and deep client relationships, we are confident they will build successfully on the company's 30-year heritage."

The transaction brought together a team of local advisors with DSG Corporate Advisory and Morecrofts acting on behalf of the vendor while Langtons Corporate Advisory and Primas Law acted on behalf of the new management team.

Find out more about the growing popularity of management buy-outs

This specialist facility offers a unique opportunity for those interested in high-performance engines, with 40 years of expertise in building, restoring, and testing.

This long-established general engineering and fabrication business boasts a skilled workforce and a credible client base, serving diverse industries including oil and gas and renewable energy.

This is a unique opportunity to acquire a globally recognised, IP-led engineering company with over 100 patents in advanced materials, including graphene, and an accomplished leadership team with vast industry experience.

|

29

|

|

Aug

|

Weir Group completes acquisition of Townley Engineering | BUSINESS SALE

Global engineering solutions provider, Weir Group, has offic...

|

29

|

|

Aug

|

Carlyle acquires UK wealth-tech provider intelliflo in $200m deal | BUSINESS SALE

Global investment firm Carlyle Group has agreed to acquire L...

|

29

|

|

Aug

|

Gloucester electricals distributor enters administration | ADMINISTRATION

South West-based distributor John Gillman & Sons (Electrical...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.