Tue, 24 Jun 2025 | ADMINISTRATION

Liquidators appointed to a collapsed medical technology (medtech) firm based in Oxford are seeking buyers for the company’s assets, including intellectual property. Isansys Lifecare Limited was known for its patient monitoring systems.

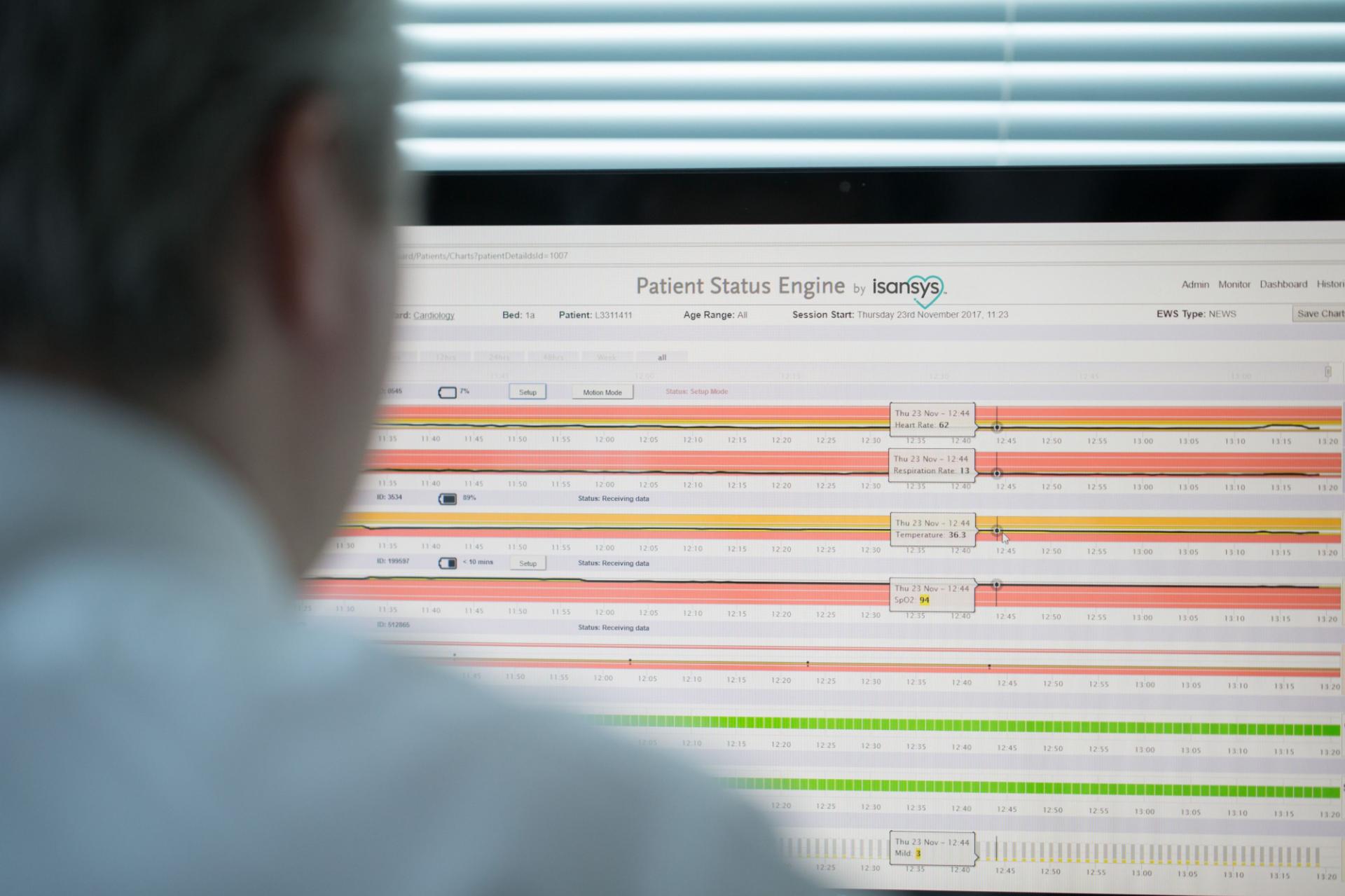

Founded in 2010, Isansys Lifecare developed and marketed advanced wireless wearable sensors and data analytics platforms that were designed to enable continuous monitoring of patients, both in hospitals and at home, with the ultimate aim of improving patient outcomes.

The company saw significant early success, achieving positive results in clinical trials and securing government grants, and in 2020 achieved sales of more than £1 million.

However, the company was subsequently impacted by the COVID-19 pandemic, which had a significant effect on the pace of adoption of its products and platforms in the UK, Europe and the US.

Following persistent financial challenges, including the high fixed costs faced by many regulated medical device companies, the firm exhausted its investor and director funding and ultimately entered creditors’ voluntary liquidation.

The sale of the company’s assets, including high-value intellectual property, research and development (R&D) assets and a recently signed licensing agreement, is now being handled by Nick Harris and Lucinda Coleman from the restructuring team at PKF Francis Clark.

Nick Harris commented: "Isansys Lifecare had an excellent reputation in the medtech sector. We are seeing significant interest in the company's intellectual property assets from a range of parties.”

"Sadly, it was not possible to rescue the company as a going concern, and there was no alternative to liquidation. Our focus now is on realising the assets of the company in order to deliver a return to creditors."

In accounts for the year ending December 31 2023, the company’s fixed assets were valued at slightly over £2 million and current assets at approximately £400,000. However, its net liabilities at the time stood at nearly £11.2 million.

The liquidators are being assisted in the asset realisation process by specialist agents Simon Bamford and Benoit Geurts of Gordon Brothers and legal adviser Andrew Knox of Stephens Scown.

Find out more about the key considerations when acquiring intellectual property in this in-depth, exclusive guide

Read about the major trends influencing M&A activity in the UK's medtech sector

We are delighted to bring this thriving cosmetic surgery clinic to the market. Located in London’s prestigious medical district, Harley Street, this CQC-registered business specialises in a wide range of plastic surgery procedures.

This is an exclusive chance to acquire a renowned cardiology practice situated in the prestigious London medical district.

LEASEHOLD

Established in 2015, our client has built a reputation for quality, service-user-focused care that has won it a very favourable position when bidding for work from local councils. It has also built up a healthy and growing private client base in that...

|

08

|

|

Aug

|

Former Shropshire care home up for sale for £450,000 | COMMERCIAL PROPERTY

A former care home in Shropshire has been put up for sale wi...

|

08

|

|

Aug

|

South West brass instruments manufacturer acquired by Italian firm | BUSINESS SALE

Denis Wick Products Limited, a South West-based manufacturer...

|

08

|

|

Aug

|

Logistics firm acquires supply chain services provider and parcel of land | BUSINESS SALE

Williams Shipping, a longstanding marine and logistics servi...

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

We can help you capitalise on insolvent businesses. We list UK businesses in administration, liquidation and with winding up petitions daily. Ensuring our members never miss out on an opportunity

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.