Mon, 11 Mar 2019 | BUSINESS SALE

National waste management business, CSG, has successfully completed the acquisition of Hutchinson Environmental Solutions wastewater treatment company.

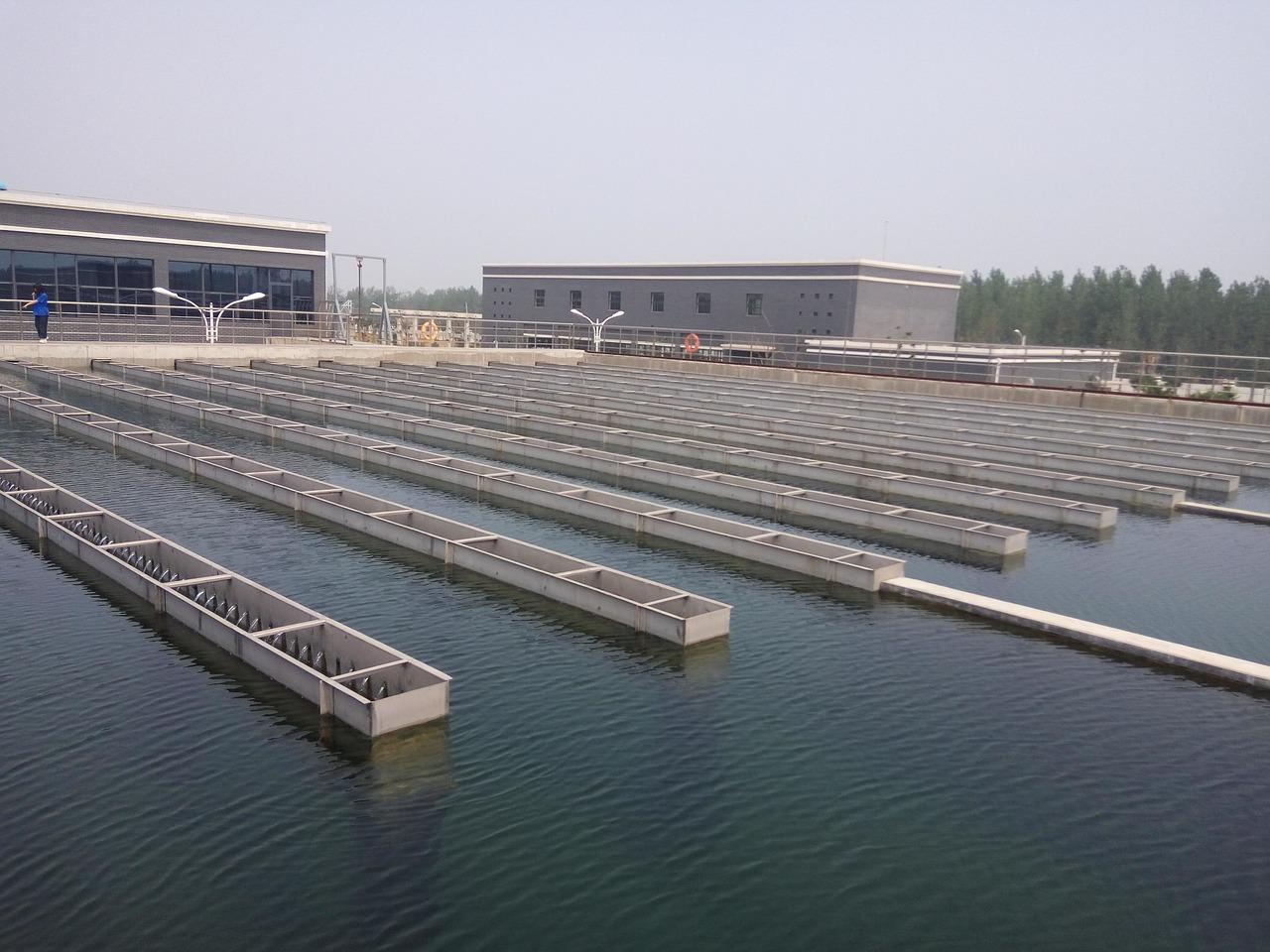

Located in Hexham, Northumberland, Hutchinson Environmental Solutions handles and the design and installation of off-mains wastewater treatment infrastructure, sewage treatment system, and packaged pump stations across areas in the south of Scotland and north of England.

The company is co-owned by Doddie Weir, a former Scottish international rugby union player.

The acquisition will see the business and all 26 of its employees, including Peter Stedman, the operations director, become a part of CSG which is headquartered in Hampshire.

CSG’s managing director, Neil Richards, commented on the acquisition, stating: “Hutchinson Environmental Solutions has an unrivalled reputation across the North of England and Scotland, and we have worked in partnership with the company for a number of years, with CSG covering more of the South.

"This acquisition creates the only national company providing the full supply, installation, service and maintenance of wastewater treatment.

"Bringing together the Hutchinson team, along with CSG’s network of operating facilities, will deliver a nationwide consistency of service for domestic and industrial customers."

Stedman, who is also the co-owner of Hutchinson Environmental Solutions, said: "We have enjoyed working with CSG for many years – great people and great culture – so we are really excited about where the future will take us."

For more news stories about acquisitions, click here. For all our business for sale listings, click here.

This precision calibration and process control solutions provider in West Sussex offers a chance to acquire a business with an established industry reputation and specialist technical expertise.

This long-established general engineering and fabrication business boasts a skilled workforce and a credible client base, serving diverse industries including oil and gas and renewable energy.

This well-regarded civil engineering company in Scotland offers specialist drainage and surfacing solutions, with a robust client base including large public and private organisations. The business boasts a strong reputation in a competitive market,...

|

05

|

|

Sep

|

Administrators exploring sale after collapse of Bodycare | ADMINISTRATION

Bodycare, a high street retailer of branded health and beaut...

|

05

|

|

Sep

|

Pets Choice acquires Kennelpak brands out of administration | BUSINESS SALE

Pet food manufacturer Pets Choice has acquired a number of p...

|

05

|

|

Sep

|

PE-backed legal services group completes investment in London firm | BUSINESS SALE

Legal services group BBS Law has completed an investment in ...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.