Tue, 14 Jan 2025 | BUSINESS SALE

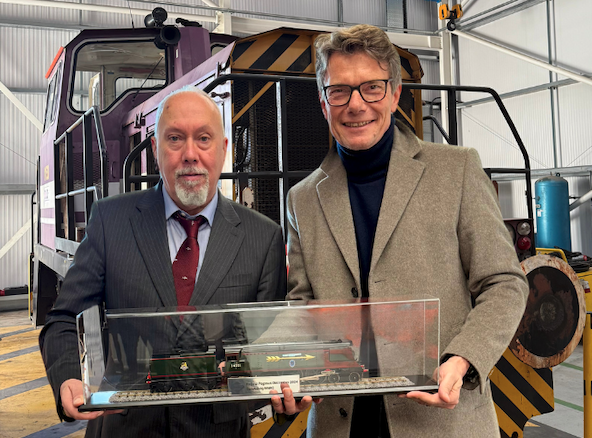

Swietelsky AG, one of the leading European construction companies in the rail infrastructure sector, has bought 100 per cent of the shares of UK-based Harry Needle Railroad Company Ltd (HNRC).

Founded in 1998, HNRC, with headquarters in Worksop and another facility in Barrow Hill, is one of the most renowned providers of maintenance, repair and rental services for locomotives and rail vehicles.

The company operates a state-of-the-art multi-purpose facility for rail services on a 14-hectare site in Worksop and employs more than 30 people. In the 2023/2024 financial year, HNRC achieved an operating performance of around €9 million (£7.5 million).

With the takeover, Swietelsky is expanding its portfolio in Great Britain to include key areas such as locomotive repairs, fleet management and track rental.

"This strategic step not only enables us to expand our market position in the area of Operate & Maintain contracts for Network Rail, but also to significantly increase our capacities for machine overhauls and future innovations such as the conversion of rail vehicles to European train protection systems," explained Peter Krammer, CEO of Swietelsky AG. "The synergies between our existing business areas and the competencies of HNRC offer an excellent basis for sustainable growth and the development of new business areas."

Main funder Frontier Development Capital will exit its investment in HNRC as a result of the deal.

HNRC was created by former paratrooper Harry Needle. He started out recovering spares from redundant rolling stock and went on to acquire a fleet of locomotives for hire. In 2019, with backing from FDC it acquired the derelict former rail depot in Worksop and invested £8 million to convert it into a complete operations centre.

Jack Glonek, investment director at FDC whose investment in Harry Needle came from its Rail Supply Growth Fund, said: “Harry Needle Railroad Company was already successful but with the acquisition of the Worksop site, it began a new era that saw it become a leader in its field. It has been a privilege working with Harry and his team, supporting them with multiple investments and watching the business go from strength to strength.”

Find out why more PE firms are looking to exit

This South London-based construction specialist is a leader in hard surface repair and restoration, with an impressive international footprint. They offer an environmentally friendly alternative to replacement, significantly reducing both landfill wa...

This business offers an established presence in the UK trailer hire market, renowned for innovative and durable trailer solutions across various industries.

This company presents a unique opportunity to acquire a well-established supplier of engineering components and fabrication services, known for its unparalleled product knowledge and fast dispatch times. With an ISO-accredited workshop and a skilled,...

|

18

|

|

Sep

|

Estate agency group acquires pair of County Durham letting agencies | BUSINESS SALE

My Property Box, an estate agency group backed by BGF, has f...

|

18

|

|

Sep

|

Historic garden machinery business closes after 135 years of trading - asset sale | BUSINESS SALE

A historic Warrington lawnmower and garden equipment busines...

|

17

|

|

Sep

|

Construction materials firm acquires civil engineering contractor | BUSINESS SALE

Fox Brothers Holdings, a private equity-backed construction ...

|

20

|

|

Nov

|

Watermark continues journey with MBO | MBO/MBI

Watermark, which helps turn airlines into ‘hotels in t...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.