Fri, 02 Sep 2011 | BUSINESS SALE

UK maker of razors and shaving oils, King of Shaves, has been put on the market, with Singapore-based investment bank Alpha Advisory appointed to manage the sale process

The decision to sell came after founder Will King received takeover approaches that put a value on the business of as much as £45 million. Two potential bids have already been received from US shaving firm Remington and Kai Industries, which already owns 21 per cent of King of Shaves.

Based in Beaconsfield, Buckinghamshire, King of Shaves sells its products to Tesco, Sainsbury’s and Boots, along with large US retailers. Will King set up his razor business in 1993 from his home with £15,000, and once used Speakers’ Corner in Hyde Park to promote King of Shaves.

It has been predicted that a buyer may come from Asia, which is expected to be an important area for growth.

With sales of about £25 million, the King of Shaves has emerged as a direct competitor to Proctor and Gamble’s men’s shaving brand Gillette.

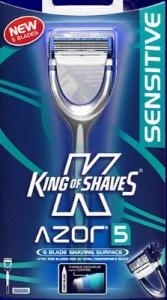

The brand is due to launch its Azor % razor in the autumn to challenge Gillette’s Fusion ProGlide product.

This specialist subcontractor, operating through two divisions, offers comprehensive drylining, steel framing systems, and decorating services, boasting a strong foothold in a high-barrier sector across South East England. With an established network...

This company represents a lucrative acquisition opportunity with its established reputation and strong blue-chip client base, providing consistent, repeat business. It offers a comprehensive range of construction solutions, including project manageme...

This well-established dental practice in North West London, with a history of over 20 years, boasts consistent revenue growth and a high UDA rate within its largely NHS-based revenue stream.

|

04

|

|

Sep

|

Lettings software firm Dwelly acquires Midlands estate agency | BUSINESS SALE

Lettings software firm Dwelly has completed its latest M&A d...

|

04

|

|

Sep

|

County Antrim seafront hotel hits the market for under £5m | COMMERCIAL PROPERTY

The Marine Hotel, a prominent seafront hotel located in the ...

|

04

|

|

Sep

|

Property firm acquires property consultancy in PE-backed deal | BUSINESS SALE

Dundee-based chartered surveyor and property consultancy Gra...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.