Wed, 26 Feb 2020 | DIVISION SALE

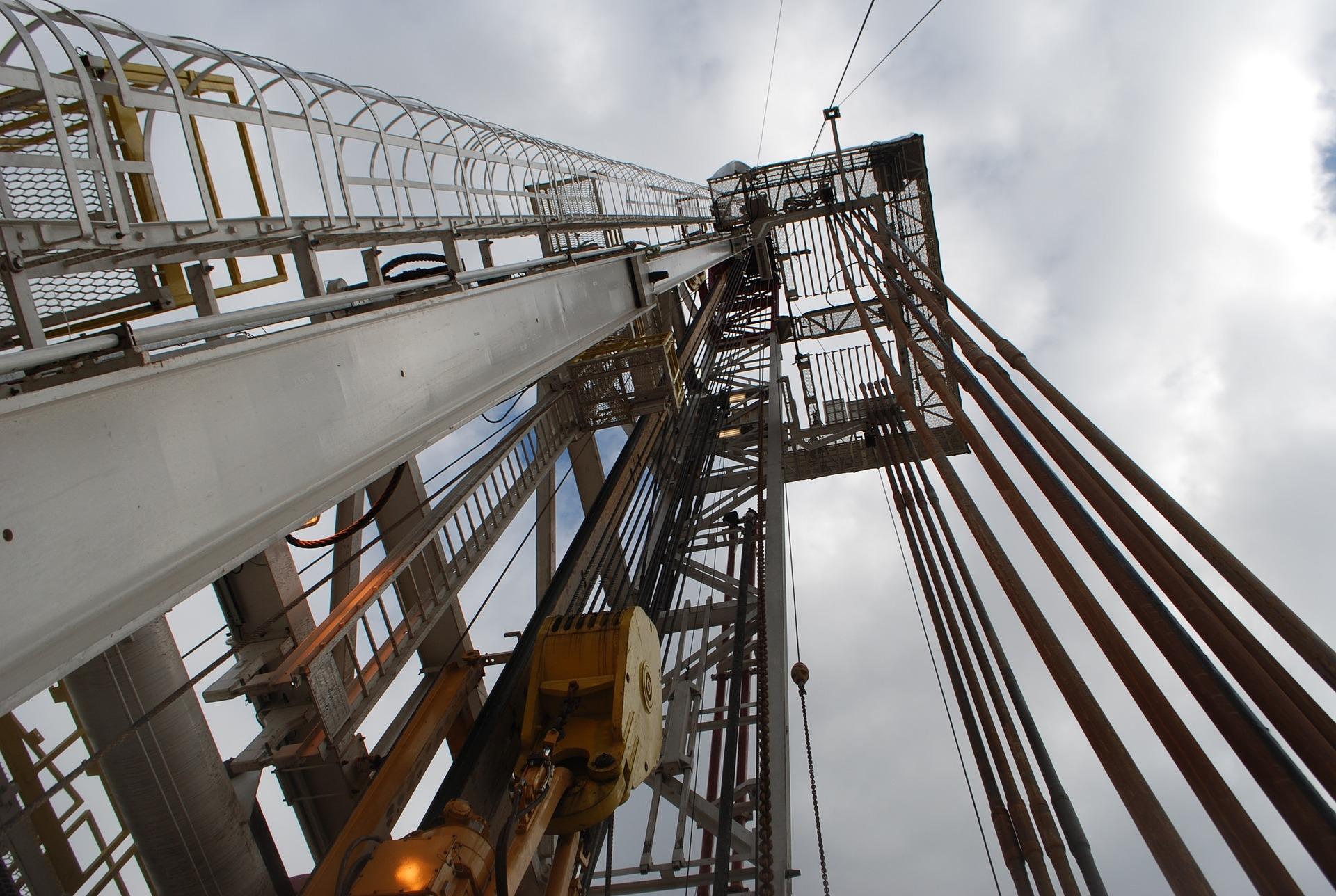

Scottish engineering giant Weir Group is looking to sell its oil and gas business and focus its efforts on its mining division.

A downturn in the American shale gas market saw Weir incur losses and a £546 million oil and has impairment charge saw it report a pre-tax loss of £372 million for the year ending December 31, 2019, down from £86 million profit in 2018.

Despite this, the group’s operating profits rose to £352 million, up from £348 million in 2018. The minerals arm of its mining division posted a 4 per cent revenue rise to £1.478 billion, along with a 7 per cent operating profits increase to £270 million.

Discussing these results and the decision to sell, Weir Group chief executive John Stanton said: “2019 saw a strong performance from our mining businesses with margin expansion in both Minerals and ESCO.”

“North American oil and gas market conditions deteriorated significantly through the year and we undertook a major cost reduction programme in response.”

“While the long-term prospects for shale remain positive, current market dynamics mean it now has a very different investment case to our premium mining technology positions.”

“We are therefore taking actions so that we can maximise value for shareholders whenever the right opportunity is identified.”

The group’s total dividend has increased 2 per cent to 46.95p and its board said that the decision to sell reflected “confidence in the long-term prospects of the group.”

Looking to the year ahead, Stanton said there was “uncertainty over the impact of coronavirus on the global economy and demand for natural resources.”

He added that: “Assuming underlying demand does not change, we expect further good constant currency growth in our mining-focused businesses to be offset by the continued challenges in North American oil and gas markets.”

Discover the rare chance to acquire a specialist UK supplier of marine engines and generators, noted for their leadership in the used marine engine market and hard-to-find parts.

Discover a unique opportunity to acquire a distinguished business in the realm of specialist precision engineering and manufacturing, renowned for its high-quality products and innovative solutions.

This is a rare opportunity to acquire a first-class HVAC installation, servicing, and maintenance contractor based in Yorkshire, renowned for its outstanding reputation and consistent high standards.

|

17

|

|

Sep

|

Construction materials firm acquires civil engineering contractor | BUSINESS SALE

Fox Brothers Holdings, a private equity-backed construction ...

|

17

|

|

Sep

|

Assets and IP of non-HFSS bakery brand set to be sold in pre-pack deal | ADMINISTRATION

Urban Legend, a healthier sweet bakery brand, is poised to e...

|

17

|

|

Sep

|

Regional care home operator expands with double acquisition | BUSINESS SALE

Regional care home operator Maven Healthcare has expanded wi...

|

29

|

|

Aug

|

Weir Group completes acquisition of Townley Engineering | BUSINESS SALE

Global engineering solutions provider, Weir Group, has offic...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.