Wed, 15 May 2024 | MERGER

Audit, tax and business advisory firm MHA has announced a merger with Ireland-based accountancy and advisory Roberts Nathan. The new partnership, which will take effect from July 1 2024, will be known as Baker Tilly Ireland and follows MHA’s recent merger with MHA Moore & Smalley.

Roberts Nathan has offices in Dublin and Cork and the merger will combine the company’s local expertise with a significant international presence, majorly strengthening its capacity to offer a comprehensive range of services.

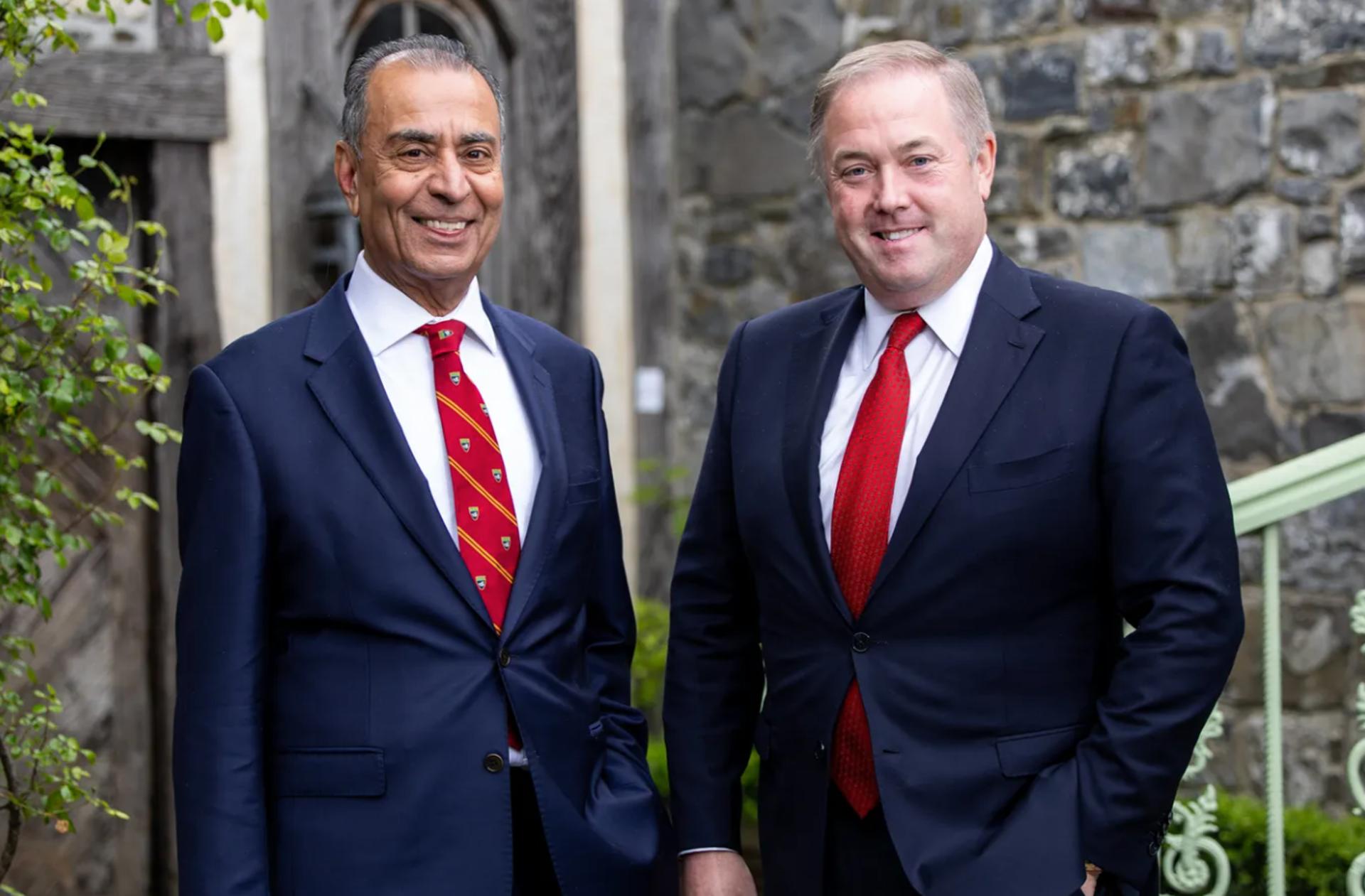

Rakesh Shaunak, Managing Partner and Chairman of MHA, commented: "Expanding into Ireland is a significant step in MHA's strategic growth plans given the country's strong trading ties and business connections with the UK and mainland Europe, as well as its thriving business community, and resilient economy.”

"Our focus in Ireland will remain on supporting local and international SMEs, enabling local clients to take advantage of the international footprint of Baker Tilly International, and also allowing our UK clients new opportunities to enter the Irish Market.”

Shaunak added that Roberts Nathan’s “growth mindset, entrepreneurial spirit and highly personal ethos” aligned "perfectly” with MHA’s own approach.

Roberts Nathan Managing Partner Vivian Nathan will become Baker Tilly’s new Regional Chief Operations Officer following the merger.

Vivian Nathan said that the merger marked a “pivotal milestone” for the company and would enable the firms " to leverage our combined strengths to provide more extensive services and innovative solutions to our clients while creating significant growth opportunities for our team."

The latest merger continues a busy period of growth for MHA, with the company opening offices in Scotland and Wales in 2023, before announcing the merger with MHA Moore & Smalley at the start of 2024.

Read more about MHA's merger with MHA Moore & Smalley

Find out more about how accountancy firms are using M&A to broaden their service offerings

This well-established West Midlands IFA, managing £200m in funds under management, offers a highly profitable client base with an average household value exceeding £400k.

An exclusive opportunity to acquire a prestigious ultra-high-net-worth independent financial advisory business in Kent, managing £70m in funds under management.

An established Northern Ireland IFA presents a unique opportunity with £500k in recurring revenue and an average client value exceeding £350k, offering a portfolio of highly profitable clients.

|

12

|

|

Sep

|

Leeds care home operator sold to new owner | BUSINESS SALE

Bond UK Limited, the company behind two care homes in Leeds,...

|

12

|

|

Sep

|

Motorhome and marine electronics manufacturer rescued in pre-pack deal | BUSINESS SALE

An East Midlands-based electronics manufacturer and seller h...

|

12

|

|

Sep

|

Acquisitive insurance group completes triple takeover | BUSINESS SALE

Insurance brokerage JMG Group, which has completed 50 acquis...

|

11

|

|

Jan

|

Accounting firms MHA and MHA Moore and Smalley in strategic merger | MERGER

UK accounting firms MHA and MHA Moore & Smalley have announc...

|

17

|

|

Feb

|

Manchester-based software company acquired by Totalmobile | BUSINESS SALE

Employee management software company, Working Time Solutions...

|

21

|

|

Jun

|

Healthcare firm announces three-year £100m acquisition plan | BUSINESS NEWS

Tyneside-based healthcare firm Salutaris People has unveiled...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.