Sun, 01 May 2016 | MERGER

If the European Commission approves Anheuser-Busch InBev’s merger with SABMiller PLC, the brewer will be putting its Eastern and Central European beer brands up for sale for as much as £4.8bn.

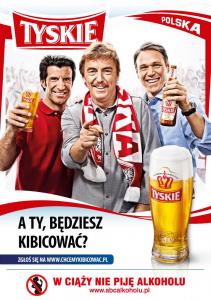

Up for grabs will be SABMiller’s assets in Poland, Slovakia, Czech Republic, Hungary and Romania. These include brands such as Polish beers Tyskie and Lech, Hungarian beer Dreher and Romanian beer brand Ursus. Also included in the sale are the rights to the Pilsner Urquell brand outside the United States.

The brands reportedly account for around £1.6bn in annual sales, with EBIT of £310m according to Exane BNP Paribas analysts, who have accordingly placed a valuation of £3.4 bn on the assets. However analysts at Morningstar say that as this year’s underlying earnings are forecast to reach £480m, the sale price is likely to be considerably higher than this figure.

Possible suitors include Asahi, Heineken and Carlsberg.

Part of the reason for the sale of course is to allay any antitrust fears the EC may have concerning the takeover, scheduled to complete in the second half of 2016.

SABMiller is the second largest brewer in the world, behind Anheuser-Busch InBev. In Eastern Europe SABMiller currently reigns as the the third-largest brewer with a 15 percent slice of the market. AB InBev has just 8 percent of the market. SABMiller’s Eastern and Central European beer brands were largely put together in a consolidation acquisition strategy around 20 years ago. Anheuser-Busch InBev does not seemed too concerned about losing its European business – what is really after is SABMiller’s growing and lucrative brewery operations in Africa.

This is an opportunity to acquire the shares, business and/or assets of an electrophoretic and powder coating specialist located within the North East of England. Indicative proposals, supported by proof of funding, are accepted by no later than 4pm...

This unique holiday accommodation business offers distinctive, design-led stays on over 15 acres of private land, complete with exceptional amenities and a residential property. With a strong occupancy rate of over 90% and excellent guest reviews, it...

FREEHOLD

This exceptional opportunity allows you to acquire a leading UK business in pneumatic tube systems for healthcare, boasting exclusive distribution rights and strong client retention through multi-year service agreements.

|

16

|

|

Sep

|

SRG expands retail division with acquisition of North West broker | BUSINESS SALE

Insurance underwriting and broking firm Specialist Risk Grou...

|

16

|

|

Sep

|

Pair of Midlands furniture brands fall into administration | ADMINISTRATION

Administrators are set to market the assets of a pair of Mid...

|

16

|

|

Sep

|

Training provider to pursue acquisitions with new PE backing | BUSINESS NEWS

Inspiro Learning, a Doncaster-based independent training pro...

|

08

|

|

Oct

|

CMBC set to close 150-year-old Wolverhampton brewery | ADMINISTRATION

Carlsberg Marston’s Brewing Company (CMBC) is set to c...

|

23

|

|

Nov

|

Former Carlsberg offices on the market for £2.7m | COMMERCIAL PROPERTY

Office buildings in Northampton previously owned by Carlsber...

|

05

|

|

Mar

|

Hawthorn Leisure pub chain up for sale | BUSINESS SALE

Hawthorn Leisure, a firm led by co-founder CEO Gerry Carroll...

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

All this and much more, including the latest M&A news and exclusive resources

Please choose your settings for this site below. For more information please read our Cookie Policy

These cookies are necessary for our website to function properly and provide you with access to all features.

These are analytics cookies that help us to improve the way our website works.

These are used to improve the functional performance of the website and make it easier for you to use.